The crypto market on May 31, 2025, experienced significant turbulence driven by macroeconomic factors and regulatory developments. Within the last 24 hours, key events shaped market sentiment, from trade tensions to pivotal SEC decisions and exchange service changes. Here’s a concise recap of the most notable updates in the crypto space.

Trade Tensions Spark Crypto Market Volatility

Crypto markets faced downward pressure following U.S. President Donald Trump’s announcement of a steel tariff hike from 25% to 50%.

- This escalation in U.S.-China trade tensions triggered a risk-off sentiment, causing Bitcoin and major altcoins to slide in early trading sessions.

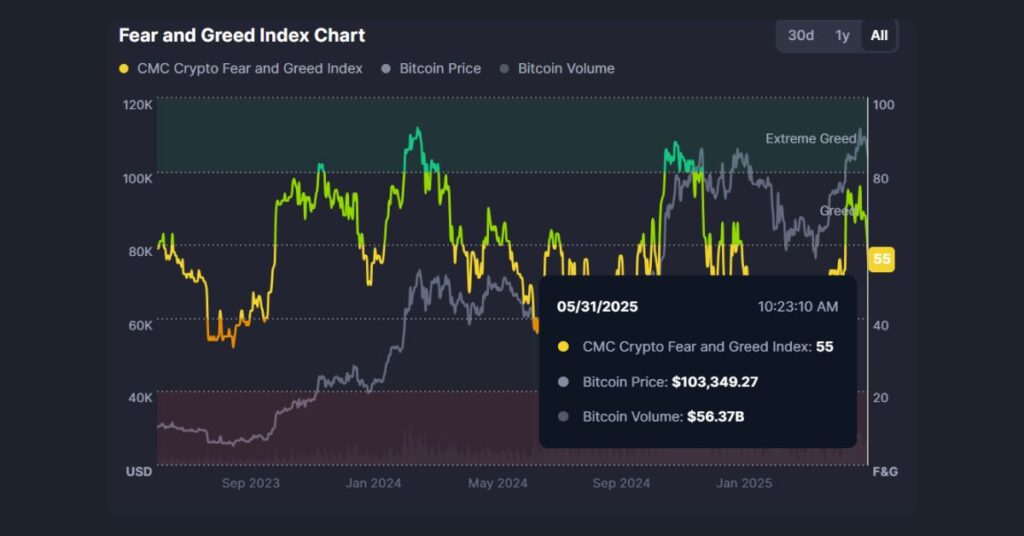

- The Fear and Greed Index reflected this caution, signaling a shift toward neutrality.

- Price Movements:

- Bitcoin dipped slightly, hovering around $104,000.

- LPT surged over 130%, reaching $12.45, while Solana-based $LABUBU hit a $65M market cap before cooling to $ 57 M.

- A prominent whale, James Wynn, suffered a $96M loss in seven days, with only $800,000 remaining after liquidating $BTC and $PEPE positions.

Meme Coin Trendings

- $LABUBU: A Solana meme coin hit a $65M market cap before cooling to $57M.

- $MASK: A Solana meme coin emerged from the mythical CS:GO (Counter-Strike: Global Offensive) mask-wielding cat and meme phrase “Cyka Blyat.”

- $KITTY: The world’s most iconic cat, taking over Solana.

- $QUAK: “Quak Wif Boi” – Glue was just the start. Now it’s a degen collective.

- $Willy: A meme coin gaining traction on the Solana blockchain, with an active community sharing updates and insights

- $GT: Gangster Trump hit $56.42M ATH market cap in first 24 hours.

- $LOUD: The heart token of Loudio, a groundbreaking SocialFi project on Solana, designed to explore the value of attention in the digital age.

- $MOONPIG: It broke through a falling triangle pattern at $59 million and is now facing resistance at $22 million.

Regulatory Wins and Exchange Shifts

The crypto industry saw a significant regulatory breakthrough as the U.S. SEC withdrew its lawsuit against Binance, a major win for the exchange and the broader market.

Additionally, the SEC clarified that Proof-of-Stake (PoS) blockchains are not securities, boosting confidence in Ethereum and similar projects.

Key Exchange Update: Bybit announced the termination of most Web3 wallet services effective May 31, 2025, including cloud wallets, self-custody wallets, DEX Pro, Swap & Bridge, and its NFT marketplace.

Rising Scams and Bullish Predictions

Security remains a pressing concern, with MEXC reporting a 200% surge in crypto-related scams in Q1 2025, including a $330M loss by an elderly individual. Meanwhile, optimism persists, with Arthur Hayes forecasting Ethereum to hit $5,000 this year, and SharpLink Gaming planning a $1B Ethereum investment.

In summary, the crypto market on May 31, 2025, navigated a mix of volatility, regulatory progress, and exchange restructuring. Investors are urged to stay vigilant amid rising scams while monitoring macroeconomic developments and institutional moves for future market cues.

Share on Social Media: