In this latest crypto market recap, we dive into the whirlwind of events shaping the digital asset landscape over the past 24 hours. As of August 15, 2025, the market capitalization hovers around $4.03–$4.35 trillion, reflecting a mix of euphoric highs and sharp corrections.

Crypto Market Recap Overview

This crypto market recap highlights key developments, offering insights for investors navigating the volatility.

Bitcoin (BTC) dominated headlines by reaching an unprecedented ATH of approximately $124,457 on August 14, marking a 32% year-to-date gain. However, the rally was short-lived, with BTC dipping below $118,000 due to higher-than-expected U.S. inflation data and comments from Treasury Secretary Scott Bessent indicating no further government BTC purchases.

This triggered over $1 billion in liquidations, primarily long positions. Currently trading around $118,000–$119,000, BTC maintains a dominance of 58.7%. Institutional interest remains robust, with BlackRock’s crypto assets surpassing $100 billion and MicroStrategy adding 6,220 BTC to its holdings.

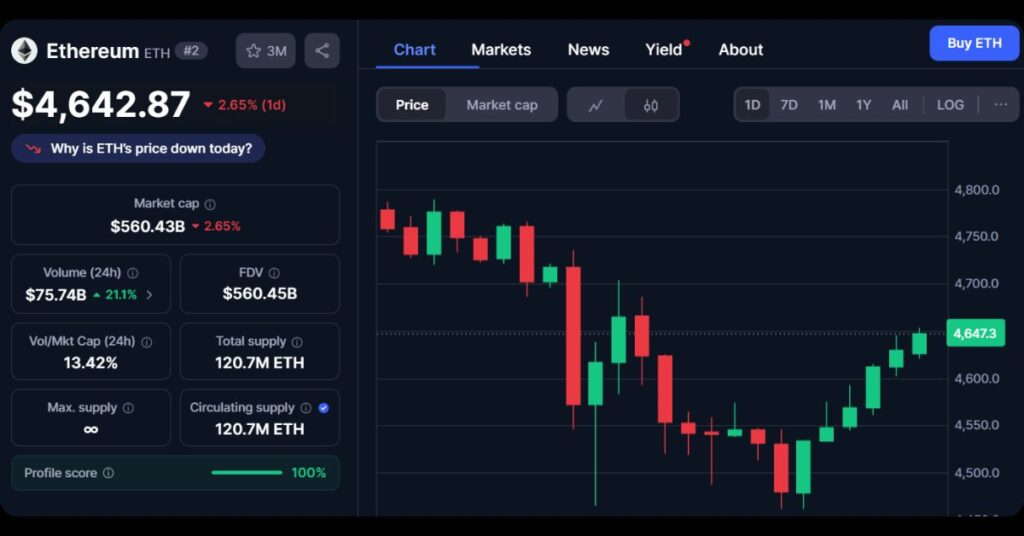

Ethereum and ETF Inflows Drive Momentum

Ethereum (ETH) showed resilience, holding above $4,500 with a 54% monthly increase. Analysts from Fundstrat and Standard Chartered project targets of $5,000–$7,500.

Spot Ether ETFs in the U.S. attracted a record $729 million in inflows last week, the second-largest on record, while BTC ETFs saw $87 million.

Google searches for “altcoin” hit 2021 highs, signaling retail enthusiasm.

Altcoins and Meme Coins: Winners and Losers

The altcoin sector exhibited mixed results in this crypto market recap:

- Solana (SOL): Surpassed $200, eyeing $250 amid DeFi and NFT growth.

- XRP: Stable above $3.10 post-U.S. exchange relistings, with whale activity hinting at a $4.20 target by Q4.

- Shiba Inu (SHIB): Dropped 7.3%, contrasting with OKB’s 129% surge from ecosystem expansions and token burns.

Meme Coins Highlights

- $CRIME (Crime Coin): Satirical Solana memecoin inspired by criminal themes, growing via viral community hype and bold narratives.

- $STUPID (Stupid Inu): Absurdity-driven memecoin on Solana, surging through aggressive marketing and high-volatility community momentum.

- $PURPLE (Just Purple): Pepe-inspired revival coin, emphasizing community strength and making Solana great again.

- $Green (Just Green): Eco-themed token, gaining traction through simple, relatable branding and viral appeal.

- $XP (Windows XP): Nostalgia-fueled meme coin on Solana, thriving on vintage software culture and shared digital memories.

- $Littleguy (Just a little guy): Underdog narrative meme coin on Solana, boosted by AI digital pet project innovation.

- $It (It Coin): Motivational ‘Do It’ meme coin on Solana, propelled by community-driven action and hype.

- $BAGS (BAGS): Trader humor-focused meme coin on Solana, expanding via speculation and holding culture satire.

- $DYNA (one): Dynamic energy memecoin on Solana, surging through innovative token mechanics and ecosystem growth.

- $fatgirls (Like buying Bitcoin in 2009): Humorous analogy, viral for overlooked potential narrative.

- $RFLIP (RugFlip): Scam-parody on Solana, growing through ironic awareness and community caution.

- $WATER (PhiProtocol.ai): Charity-oriented memecoin on Solana, endorsed for clean water initiatives and social impact.

- $Phi (PhiProtocol.ai): AI-integrated DeFi, expanding via multi-chain innovations and developer tools.

On-chain metrics reveal a total value locked (TVL) of $215 billion (+1.28%) and spot trading volume of $110.6 billion (+4.73%). The Fear & Greed Index stands at 75 (Greed), up from 73. Open interest in altcoins hit a record $47 billion, warning of potential volatility.

Regulatory and Security Updates

Pro-crypto policies under Trump, including 401(k) crypto investments, bolster institutional inflows. In Europe, Bybit’s EU launch complies with MiCA, expanding stablecoins and RWAs.

Security incidents included a $48 million hack on BTCTurk and a $300K Coinbase MEV exploit. Emerging projects like Best Wallet ($BEST) raised $14.3 million, and Bitcoin Hyper (HYPER) offers 170% APY on Solana L2.

This crypto market recap illustrates a “rollercoaster” phase with high rewards and risks. Investors should monitor U.S. inflation and ETF flows for future trends.

Stay updated with the latest crypto news by following our MevX blog!

Share on Social Media: