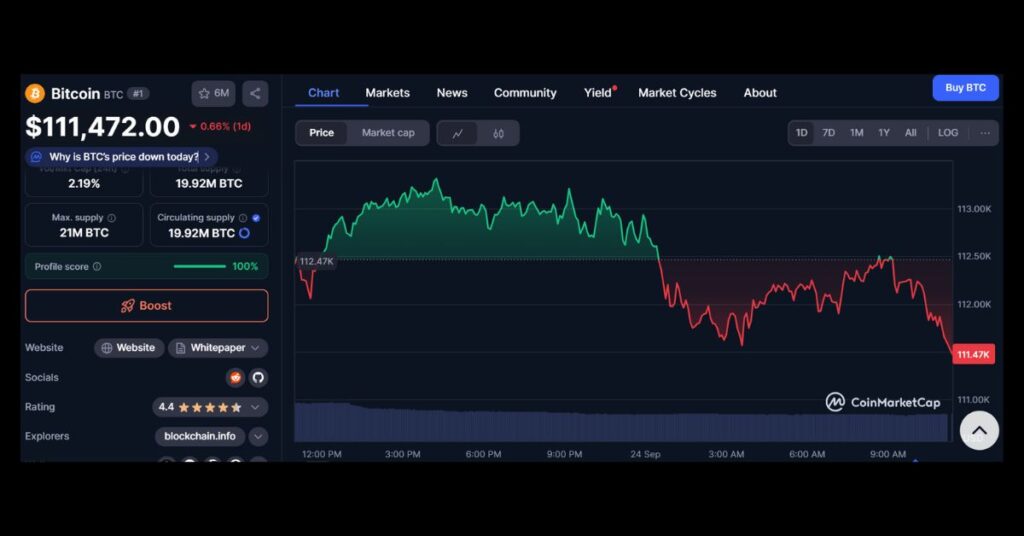

The crypto market experienced significant volatility on September 24, 2025, with a sharp downturn marking one of the largest liquidations in recent months.

Total market capitalization dropped by about $162 billion, driven by over $1.5-1.8 billion in long positions liquidated, the second-highest since December 2024.

Bitcoin hovered around $112,000-$113,000, Ethereum near $4,000-$4,200, while altcoins like Solana and XRP fell 6-12%. This “Red September” reflects ongoing inflation concerns and macroeconomic pressures.

Major Crypto Market Movements and Liquidations

- Over $1.5 billion in long positions were wiped out in just 30 minutes, pushing BTC below $112,000 before a slight rebound. Total liquidations hit $1.8 billion, affecting 407,000 traders.

- Gold reached a new all-time high of $3,725 per ounce, outperforming BTC in 2025.

- Crypto investment funds saw $1.9 billion inflows last week, but U.S. BTC ETFs recorded $363 million outflows on September 22, with ETH ETFs at $76 million.

Institutional Activity Boosting Crypto Market Treasuries

Institutions continued aggressive accumulation amid the dip:

- Metaplanet added 5,419 BTC ($632.5 million), totaling 25,555 BTC worth over $2.8 billion.

- Strategy acquired 850 BTC ($99.7 million), holding 639,835 BTC (over 3% of BTC supply).

- BitMine boosted ETH holdings to 2.42 million ($10.1 billion), Helius Medical added 760,190 SOL ($167 million), and AgriFORCE rebranded to AVAX One, raising $550 million for AVAX purchases, spiking its price 15%.

- Strive acquired Semler Scientific (10,900 BTC) and Capital B added 551 BTC.

Meme Coin Highlights

- $BEWA (Blue Eyes White Ape): Solana-based meme coin parodying Yu-Gi-Oh’s Blue Eyes White Dragon with an ape twist for viral community engagement.

- $TROLL (TROLL): Internet trolling culture-inspired meme coin on Solana, secured exclusive Trollface IP rights through six-figure deal for fun ecosystem.

- $ASTER (Aster): Decentralized derivatives platform token rebranded from APX, backed by Binance founder CZ for perpetual futures trading growth.

- $QTO (Quanto): Next-gen perpetual DEX on Solana offering 200x leverage, LP tokens as margin, and tokenized stocks for innovative trading.

- $69 (69COIN): Decentralized peer-to-peer currency enabling borderless payments, browser mining, and organic growth within meme coin community.

- $UPTOBER (UPTOBER): Meme coin celebrating October crypto rallies, gaining momentum from market optimism and influencer-driven viral promotions.

- $ASTERBOT (ASTRONAUT): Astronaut-themed meme coin on Solana blending space exploration humor with blockchain innovation for community-driven adventures.

- $Tylenol (Tylenol Gate): Humorous Solana meme coin parodying pain reliever brand, providing “relief” from market headaches via playful narratives.

- $Tokyo (Project Tokyo): Urban culture-inspired Solana meme coin aiming for viral expansion through Tokyo-themed memes and engaging community events.

- $SBF (Sam Bankman-Fried): Parody meme coin mocking FTX saga on Solana, featuring Telegram bots for crypto research and meme generation.

New Products and Regulatory Shifts in the Crypto Market

- ETFs: 21Shares launched Dogecoin spot ETF (TDOG); Canary Capital filed for HBAR ETF; Coinbase introduced Mag7 + Crypto Equity Index futures.

- Project Launches: 0G Labs mainnet (OG up 50%); Rainbow Wallet token RNBW; Plasma One neobank; Kraken’s Yield Basis for BTC; PayPal invested in Layer-1 Stable.

- Regulations: U.S.-UK crypto task force; Senate Democrats push bipartisan bill; Deutsche Bank predicts central banks holding BTC by 2030; China halts RWA tokenization in Hong Kong.

- Security: UXLINK hack ($11.3 million loss); Thai police bust $15 million scam.

Expert Insights and Niche Trends

Experts remain optimistic: Arthur Hayes sees “up only” if U.S. Treasury fills $850 billion TGA; Michael Saylor predicts 29% annual BTC growth; Vitalik Buterin urges low-risk DeFi; CZ views dips as support builders. Memecoins like APX rose; NFTs saw DX Terminal lead volume; DeFi trends included Morph incentives and Irys mainnet.

The crypto market awaits PCE data and Fed speeches this week. BTC support at $112,000 could signal a buy-the-dip opportunity.

Stay updated with the latest crypto market news by following our MevX blog for daily recaps and insights.

Share on Social Media: