As the crypto market navigates a period of cautious optimism in September 2025, investors are closely watching a wave of crypto token unlocks that could influence prices and liquidity. With a total value nearing $4.5 billion, these events represent the largest monthly release of the year, blending cliff and linear unlocks across major projects.

Understanding Crypto Token Unlocks

Crypto token unlocks refer to the scheduled release of previously locked tokens, often from vesting periods for teams, investors, or ecosystems.

In September 2025, the breakdown includes about $1.17 billion in cliff unlocks and $3.36 billion in linear unlocks, which are distributed gradually to mitigate volatility. These mechanisms aim to align long-term incentives but can lead to selling pressure if demand doesn’t keep pace.

The concentration of unlocks between September 12 and 20 adds to the intrigue, potentially fragmenting liquidity and amplifying price swings in DeFi and Layer-1 sectors. Projects like Sui and Ethena have already seen early-month activity, setting the stage for what’s ahead.

Key Crypto Token Unlocks to Watch

Here are some of the most significant crypto token unlocks this month, with details on values, dates, and supply impacts:

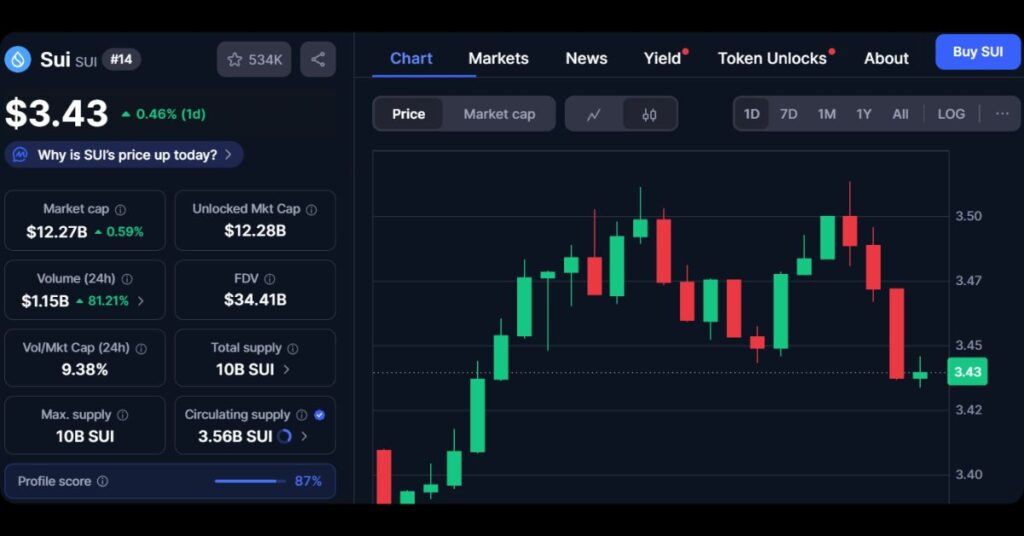

- Sui (SUI): Up to $184 million unlocked on September 1, representing a mix of cliff and linear releases. With only 35.1% of supply circulating prior, this could pressure its Layer-1 ecosystem if not absorbed by strong DeFi demand.

- Ethena (ENA): Around $108 million on September 2 (2.6% of circulating supply), with lingering effects into mid-month. This DeFi project’s synthetic dollar protocol might face extended supply pressure, impacting prices around $0.64-$0.66.

- Aptos (APT): Approximately $48-50 million on September 12 (1.6-2.2% of supply), mainly for investors and teams. Short-term downside risks loom if trading volume remains low.

- Arbitrum (ARB): About $45-48 million on September 16 (1.7% of supply), focused on Layer-2 scaling. Linear elements may soften the blow, but DeFi exposure could heighten volatility.

- LayerZero (ZRO): Roughly $47.5 million on September 20 (over 10% of supply), a major cliff event for cross-chain interoperability. This poses a high risk for sharp dumps if holder sentiment wavers.

- BounceBit (BB): Estimated $5.7 million between September 10-13, targeting investor tokens. With lower volumes, prices might dip 5-10% short term. (Note: Based on current estimates; actuals may vary.)

Other notable mentions include Sonic (S) with $150 million, Starknet (STRK) at $16 million on September 15, and Velo (VELO) at $28 million on September 17.

Potential Impacts and Investor Considerations

While unlocks can inject liquidity and support project growth, they often spark concerns over sell-offs, especially in a market with total capitalization around $3.84 trillion.

Factors like recipient types (e.g., internal teams vs. public investors) and overall sentiment play key roles. In the first week alone, over $116 million entered circulation, with some tokens like ENA showing resilience amid broader gains. Investors should monitor on-chain data and trading volumes to gauge absorption.

Ultimately, these crypto token unlocks highlight the evolving dynamics of tokenomics, where transparency and adoption are increasingly vital for stability.

For more in-depth crypto analysis and timely updates, follow our MevX blog today!

Share on Social Media: