ETH/BTC MVRV reveals Ethereum’s undervaluation

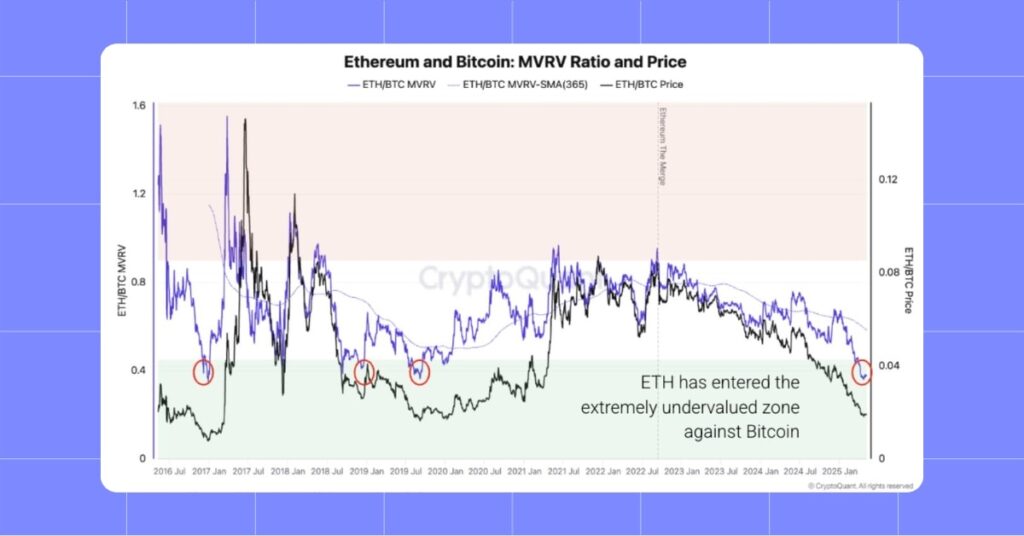

On May 8, 2025, the Ethereum (ETH)/Bitcoin (BTC) Market Value to Realized Value (MVRV) comparison indicated Ethereum is now drastically undervalued in comparison to Bitcoin for the first time since 2019. Previously, such conditions have normally led Ethereum to outperform Bitcoin, though current market conditions may curtail the likelihood of recovery.

MVRV is a measure of an asset’s value in the markets compared with its “true value,” historically approximated as the cost to owners. For Ethereum against Bitcoin, it’s the value in the markets compared with realized value in terms of Bitcoin, offering relative valuation. What we see is that when the ETH/BTC MVRV is in undervaluation, like in 2019, Ethereum would have subsequently seen significant appreciation against Bitcoin. Now, as of 2025, the ETH/BTC MVRV stands at around 0.4, Ethereum severely undervalued in comparison to Bitcoin for the first time in the past half-decade.

This underperformance suggests that Ethereum can outperform Bitcoin, according to historical trends. In 2019, an equivalent drop in the ETH/BTC MVRV triggered Ethereum’s robust rebound, as buyers seized the relative discount. Numerous factors can, nonetheless, spoil Ethereum’s comeback in the current market environment. Weak demand, supply pressures, and lackluster on-chain activity are significant dampers that can stall Ethereum’s potential to take advantage of this undervaluation. These trends contrast with Bitcoin’s relatively stable market standing, which can affect Ethereum’s future in the short term.

On May 8, 2025, Ethereum’s capitalization stands at $185 billion with trade over the last 24 hours at $12.3 billion, while that of Bitcoin stands at $1.2 trillion with trade volume of $35.6 billion. The trade pair of ETH/BTC reflects Ethereum’s distress with the pair trading at about 0.029, down from the year high of 0.045 in January this year. Despite the recovery history, Ethereum’s future with such adverse trends is far from assured.

MVRV analysis of ETH/BTC indicates potential for outperformance of Ethereum due to relative undervaluation at the moment, but caution is advisable. Although past trends have given cause for optimism, the intersection of supply and demand factors shows the intricacies of the prevailing crypto market condition.

Find more News on the MevX Blog!

Share on Social Media: