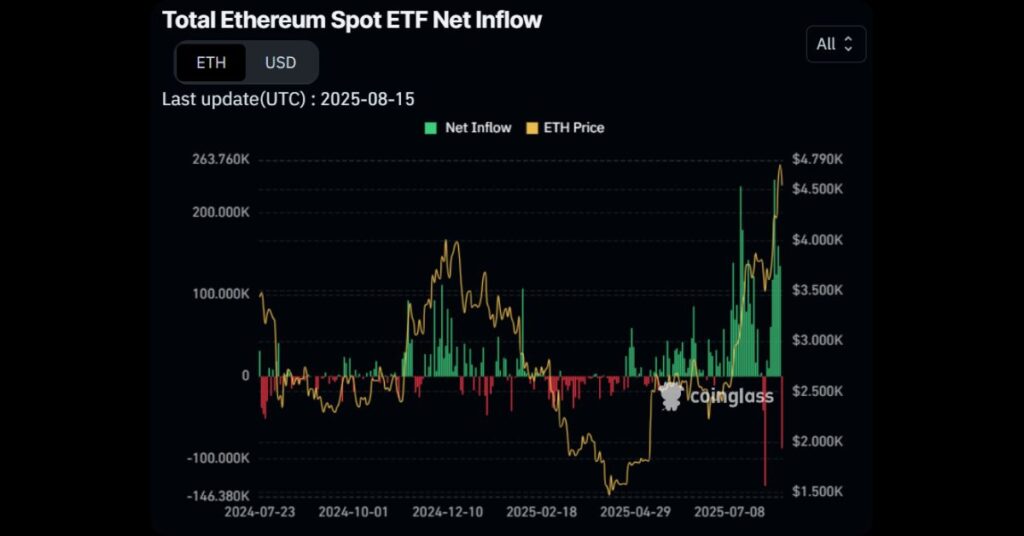

Ethereum ETF inflows have dramatically outpaced those of Bitcoin ETFs, marking a pivotal moment for altcoin adoption.

As of August 16, 2025, spot Ether ETFs have attracted over $3 billion in net inflows during the first two weeks of the month alone, surpassing Bitcoin’s comparatively modest $178 million.

This surge underscores growing institutional interest in Ethereum’s ecosystem, fueled by its proof-of-stake model and expanding DeFi applications. With Ethereum’s price climbing to a yearly high of around $4,600, up 1.6% in recent trading, analysts are eyeing potential rallies toward $5,000 or beyond.

Unprecedented Ethereum ETF Inflows Drive Market Momentum

The data highlights Ethereum ETF flows for the fifth consecutive day, with inflows reaching five times that of Bitcoin ETFs in the past week.

According to reports, U.S. spot Ether ETFs recorded daily inflows exceeding $700 million on multiple occasions, including a record $1.02 billion in a single day earlier this week. This has propelled total net inflows for Ethereum ETFs to $12.1 billion since their launch, with trading volumes hitting $4.47 billion.

This influx reflects broader trends, including corporate treasuries accumulating ETH amid falling exchange supplies and regulatory clarity. Ethereum’s breakthrough above key technical levels against Bitcoin has sparked bullish predictions, with some forecasts suggesting prices could hit $9,000 by mid-2026 if the momentum sustains.

Key Factors Behind the Ethereum ETF Boom

- Institutional Adoption: Major players like BlackRock and Fidelity are driving inflows, signaling confidence in Ethereum’s long-term utility.

- Price Catalyst: ETH’s rise to $4,600, nearing its 2021 all-time high, is directly linked to ETF enthusiasm and reduced selling pressure.

- Comparative Edge: While Bitcoin ETFs lag with slower inflows, Ethereum benefits from its ecosystem’s innovation in staking and smart contracts.

- Market Impact: On-chain data shows 28% of ETH supply in profit, bolstering sentiment as inflows continue to outstrip expectations.

As the crypto market navigates this altcoin resurgence, Ethereum ETF inflows could reshape investment strategies. However, volatility remains, with potential corrections if broader economic factors intervene.

Follow our MevX blog for daily crypto updates and in-depth analysis!

Share on Social Media: