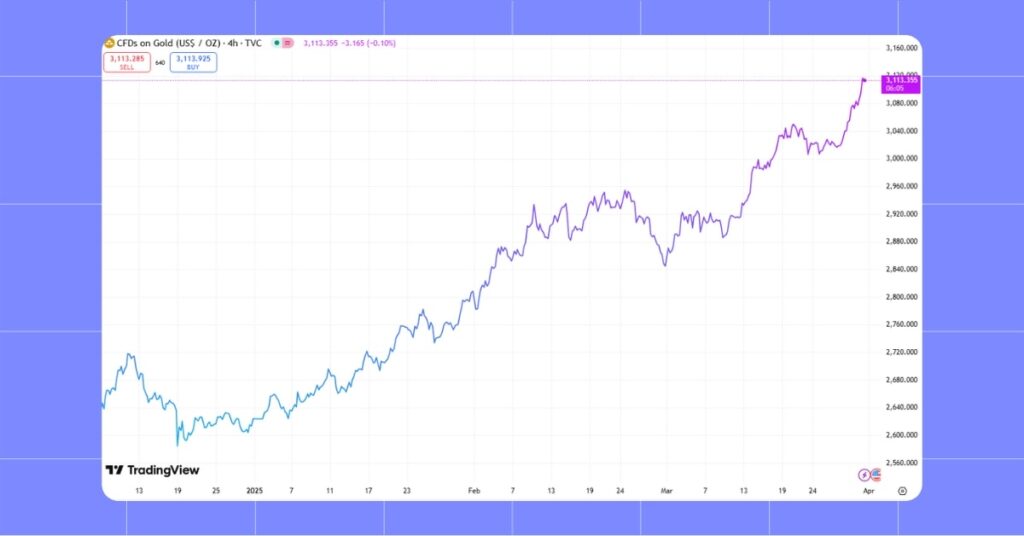

Gold just continuously hits new ATHs and is not showing any slowdown.

The global gold price shot up to record levels of $3,110 an ounce on March 31, 2025, and is continuing its upward surge. The record high is up by 50 percent compared to the past two years. Investors seek the safety of gold as the market is turbulent. Meanwhile, Bitcoin, also referred to as “digital gold,” is struggling to hold the $80,000 resistance level, as the market for cryptocurrency is registering one of the lower record low liquidity levels.

The narrative driving gold’s rally is its role as a defensive asset in uncertain times. First, U.S. President Donald Trump’s new import tariffs, including a 25% levy on non-U.S.-made cars effective April 2, 2025, have escalated global trade tensions, particularly with China and Canada. These policies have raised fears of economic slowdown, supply chain disruptions, and financial risks. Investors are turning to gold to hedge against a potential global recession.

Second, expectations of Federal Reserve rate cuts are boosting gold’s appeal. After the March 19 FOMC meeting, the Fed lowered its 2025 economic growth forecast to 1.7%, down 0.4% from December 2024. This signals potential monetary easing, making non-yielding assets like gold more attractive than bonds or bank deposits.

Third, central banks, especially in major economies like China, are buying gold to diversify reserves and reduce reliance on the U.S. dollar. In 2024, central banks added 1,045 tons to their reserves, the third consecutive year above 1,000 tons. This has tightened supply, driving prices higher, while signaling confidence in gold as a stable asset.

The market action vindicates the shift toward defensive assets. The 50 percent rise of gold on two-year terms, currently at $3,110 and still rising, is the nineteenth record high of 2025, according to Reuters. Bitcoin’s struggle near $80,000 reflects the low liquidity of the cryptocurrency market and the economic turbulence. The sluggish real estate market also narrows the channels of secure investment, placing gold under the spotlight.

However, the appreciation of gold may be a bullish signal for Bitcoin and the crypto space. As “digital gold,” Bitcoin may be a beneficiary of fresh optimism towards safe-haven assets. If the economic outlook improves, a crypto recovery may ensue. Meanwhile, gold’s continuous appreciation above $3,110 reinforces gold’s position as the ultimate defensive asset for a risky world economy.

Share on Social Media: