The 2024 US presidential election pits former President Donald Trump against Vice President Kamala Harris in an election that amounts to more than a matter of which leader America wants-it’s also a crossroads moment for cryptocurrency regulation. Mainstream adoption places cryptocurrency well within a living, breathing political landscape, with each candidate’s alternative direction promising significant shifts-one that could affect everything from the value of Bitcoin down to how crypto businesses operate in the United States. Here, we present a breakdown of the positions held by the two candidates, an analysis of historical market trends around election cycles, and an assessment of how current economic conditions add another layer of influence.

The U.S. Election Shape The Future Of Cryptocurrency?

1. Historical Election Cycle Impact on Crypto Markets

Historically, U.S. election cycles have driven substantial shifts in the cryptocurrency market. Bitcoin, for example, soared 4,268% following earlier election cycles, though returns have become less explosive in recent years.

Indeed, the year after the elections has followed a pattern of good growth in the crypto market, especially seen after the cycle of 2020 when Bitcoin’s value surged because of increased global interest and institutional investment.

This coincides with larger economic forces and Bitcoin’s Halving, an important event within the crypto space that again took place in April 2024. It cuts down on the supply of Bitcoin, which has conventionally raised its price. This past Halving could set the stage for a similar post-election growth in the cryptocurrency market.

2. Trump’s Deregulatory Stance: A Boon for Crypto?

Should Donald Trump win, he will likely approach the regulation of cryptocurrencies as he did during his term in office with a hands-off approach. His 2024 campaign has stated that he wants the U.S. to be considered a “crypto capital” and will try to reduce as many regulatory barriers as possible to let growth occur. During Trump’s presidency, the administration had a more hands-off approach toward crypto. Many in the industry favored this for better promotion of innovation while cutting down on bureaucratic hoops.

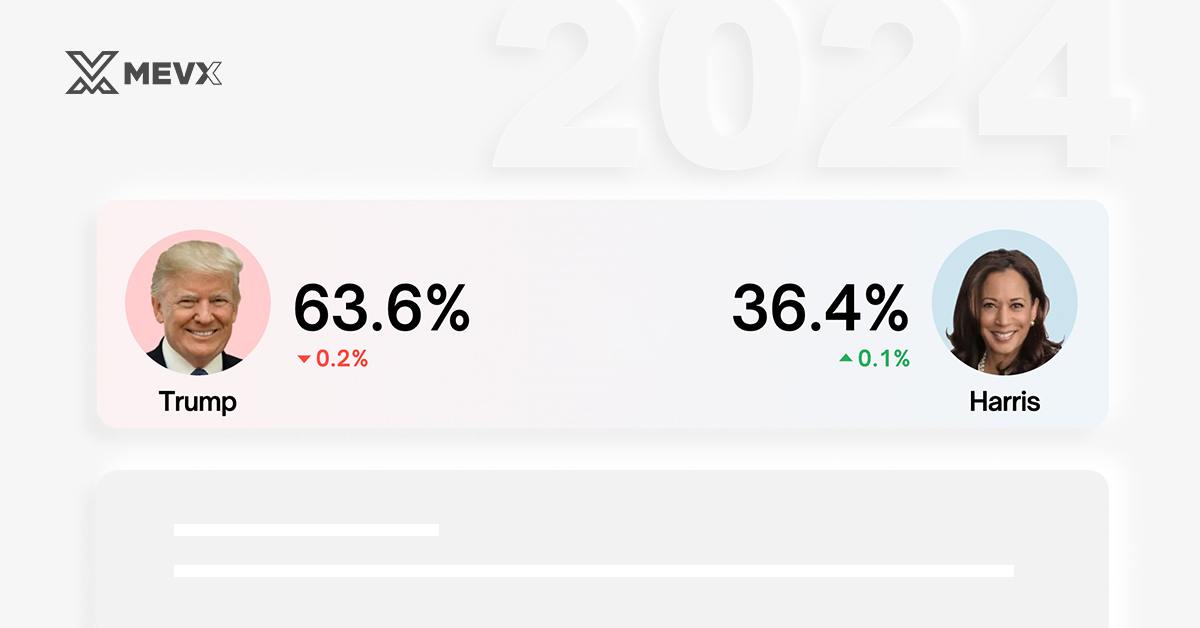

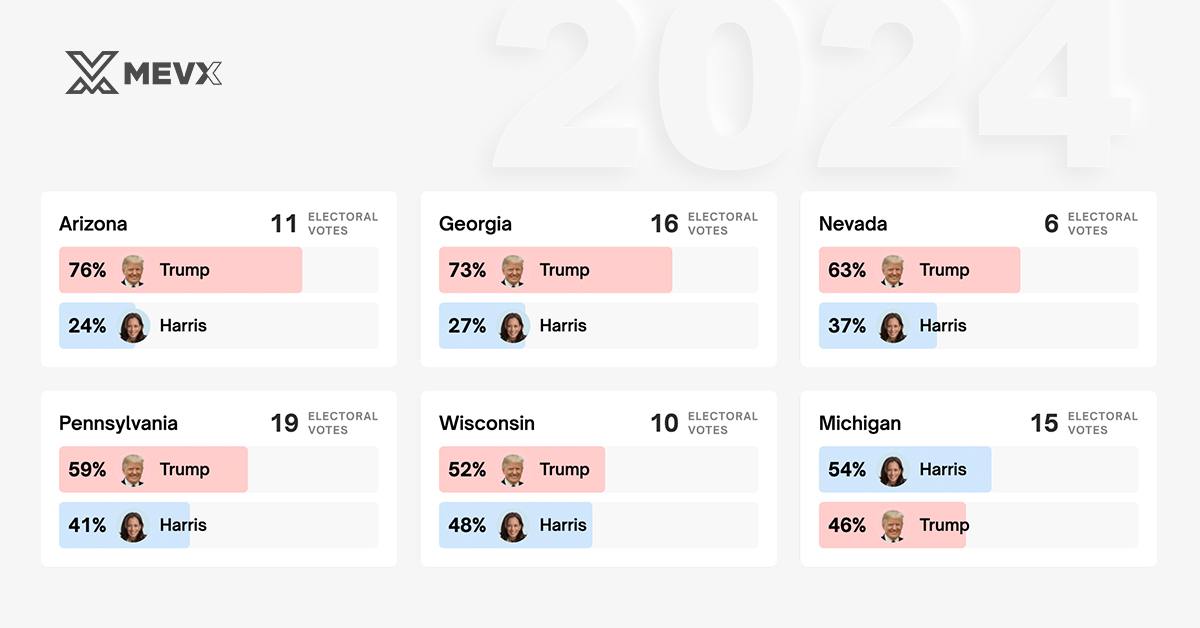

2024 Election Forecast on Nov 1st, 2024 (Source: Polymarket)

This deregulatory position is in tune with the Republican platform that conventionally embraces lower taxes and limited government interference, the very things that Wall Street and crypto fans love to see. Significantly, analysts also said that a victory by Trump could mean a spike in Bitcoin by an estimated 10.7%, since his policies may create a better environment for both decentralized financial assets and blockchain innovation.

Donald Trump has garnered fervent endorsement from the very top echelons, the multi-millionaires who lead many of the most popular cryptocurrency exchanges, including Kraken and Gemini. Founders of Gemini, Cameron and Tyler Winklevoss, in June, pledged $2 million in Bitcoin to Trump’s re-election campaign and set in concrete his crypto-friendly status.

Elon Musk, a billionaire entrepreneur and former campaign surrogate for President Donald Trump, has a new plan that involves giving away $1 million every day through November 5 to a randomly chosen person who’s signed a petition from his political action committee.

Elon Musk’s pro-Trump PAC said on Tuesday (Oct 29th, 2024) that it had mailed out more than 87,000 checks to people who secured signatures from registered swing state voters on a petition, offering a first glimpse into the scope of the controversial payouts.

With all this in place, high-profile endorsements, financial support for Trump, his deregulatory stance-the consequence of such a situation may be that there will be a lot of investment in the cryptocurrency sector. This means market confidence could go up.

3. Harris’s Focus on Innovation with Consumer Protection

In contrast, Kamala Harris has struck a good balance that will support technology while protecting consumers. Her candidacy could be an excellent indication that the tide may change in favor of technological innovation, inclusive of digital assets while remaining considerate in keeping the financial system stable and protecting investors.

2024 Election Forecast on Nov 1st, 2024 (Source: Polymarket)

Harris’ approach mirrors the Democrats in focusing regulation most on new, speculative markets. That may translate into further scrutiny of cryptocurrencies, including possible policies to reduce fraud and limit risks.

Despite these regulatory headwinds, Harris’s support of emerging tech could still help the crypto industry by giving structure to the environment. According to analysts, a Harris administration is expected to be more restrictive, and thereby drop the value of Bitcoin by around 10.5%. Such measures could promote the market in the long run by reining in unbridled volatility and encouraging investor confidence.

Kamala Harris, though late into the race, has attracted support from the sector despite joining others later in the race. On September 23, she presented her support for the industry, having a consumer protection bias. The main endorsements include Ripple’s co-founder Chris Larsen, who signed a letter in support of her, and Blockchain Foundation CEO Cleve Mesidor, who opened a $100,000 fundraiser for her campaign.

Mark Cuban, a vocal supporter and a venture capitalist, has argued that a second term would be worse for Trump. Executives at funds such as a16z and SkyBridge Capital have also lined up support, with John O’Farrell and Anthony Scaramucci of those firms, respectively, with the latter working with Harris to develop crypto policy. Taken together, the spate of support speaks to investor interest in shaping favorable crypto regulation.

4. Investor Sentiment and Broader Economic Factors

The 2024 election occurs when economic uncertainty is at its highest; either candidate is likely to inherit an economy beset by high inflation, variable interest rates, and an increasing appetite for alternative assets. Whatever the result of this election, many economists predict a trend toward lower interest rates and policies that increase liquidity. This means that both candidates are likely to resort to quantitative easing policies, which would inevitably drive the crypto market, with hard assets like Bitcoin becoming more attractive against inflation and currency devaluation.

Other strong drivers of market sentiment come from prediction markets like Polymarket and PredictIt, where pretty heavy bets on a Trump victory as a reason for crypto optimism toward a pro-business administration. Prediction markets do have something to say about investor sentiment, more so crypto investors who might like Trump’s deregulatory stance. However, one should keep in mind that such platforms are to be taken with a pinch of salt because they reflect the views of only a segment of investors.

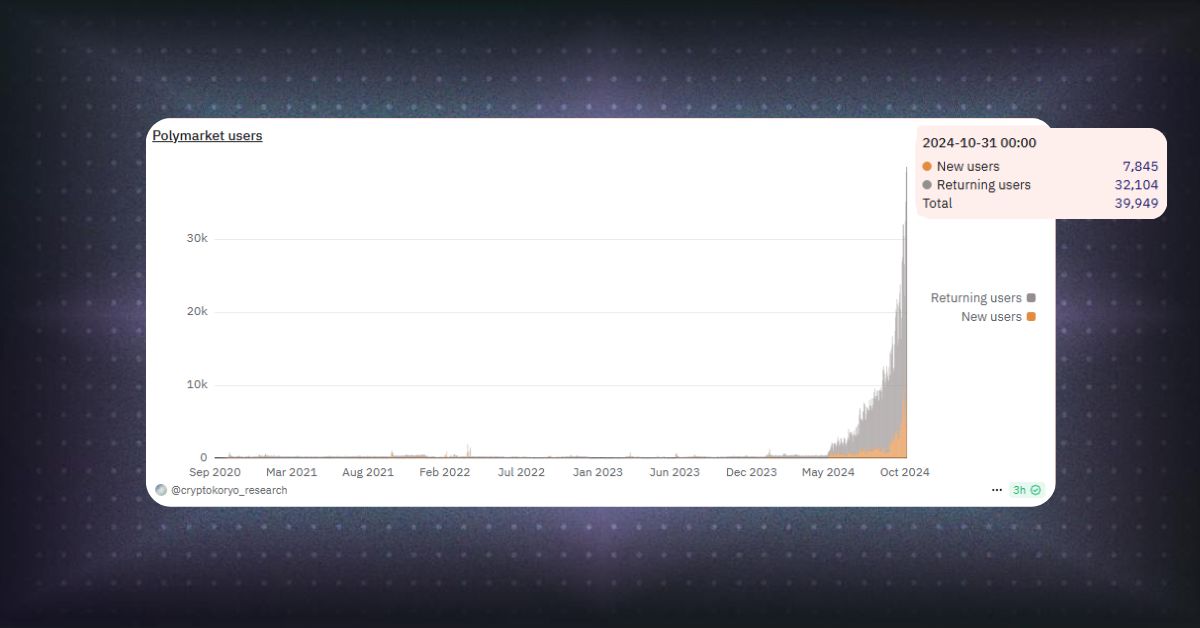

Polymarket users (Source: Dune)

It can be seen from the chart that the election has attracted a lot of users, not only new users but also welcomed returning users. Trading activities are also becoming more bustling than ever before the election.

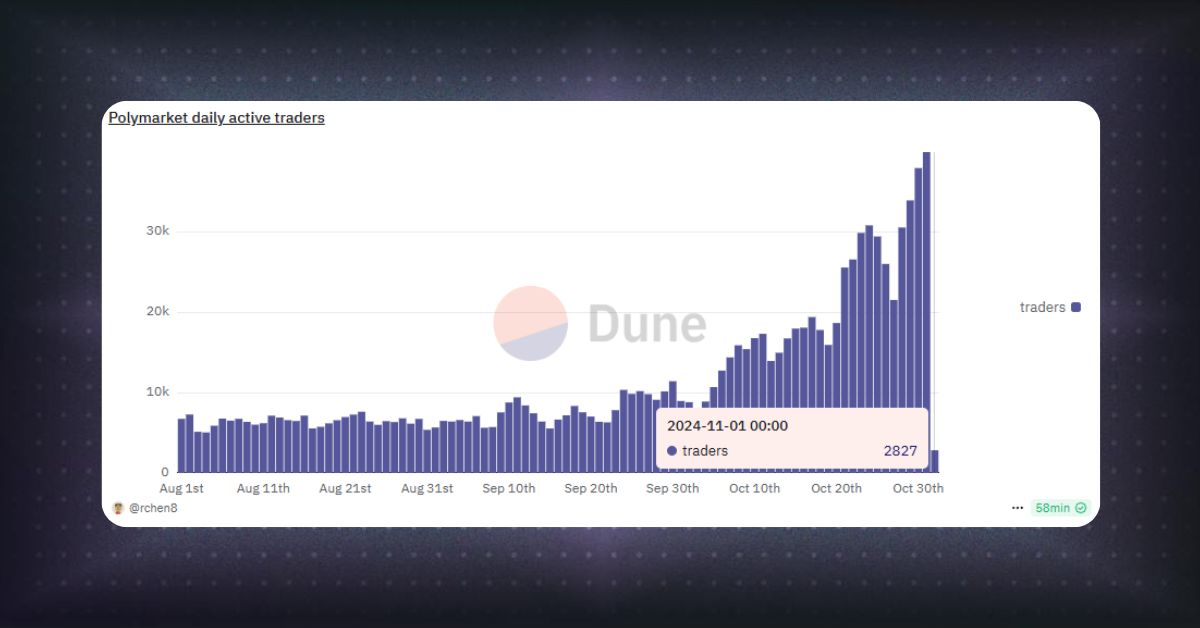

Polymarket’s daily active traders (Source: Dune)

Moreover, active traders are very active, which also contributes to the excitement of the cryptocurrency market and shows the great influence of the election on this volatile market.

Conclusion: A Crossroads for Cryptocurrency Regulation

The 2024 US presidential election will set the tone and tenor for the future of cryptocurrency regulation. From Donald Trump, promising a pro-business and deregulated environment, to Kamala Harris, who wants innovation with a dose of regulation, the stakes for the crypto market are high. A Trump victory may usher in a regulatory regime that would give way to rapid, free-wheeling innovation, while Harris could offer up a stable but restrictive environment to protect consumers and stabilize the financial system.

Crypto investors and industry leaders are hunkering down less than a month away from the election, as changes could make or break the future of digital finance in the U.S. Whichever administration takes the reins, they will play a key role in charting the future of cryptocurrency-from Bitcoin prices to enterprise blockchain adoptions.

Disclaimer

Any views and opinions that may be included in this article are solely those of the author and/or persons mentioned in the article, and any such views or opinions are for informational purposes only.

Share on Social Media: