Hyperliquid chain dominates decentralized derivatives, holding a 58% share of the on-chain perpetual futures market as of April 2025.

A new Solana bridge (via Mayan Finance) has propelled daily trading volume past $15 billion, with Hyperliquid commanding nearly two-thirds.

Hyperliquid Chain: Key highlights from Q1 2025

- Trading Prowess: Hyperliquid excels at handling complex trades with lightning speed, attracting pro traders worldwide.

- $JELLY Exploit: A trader exploited the JELLY token, causing a $13.5 million temporary loss to the HLP vault. Hyperliquid delisted JELLY, refunded users via the Hyper Foundation, and introduced stricter vault limits and liquidation rules.

- HyperEVM Launch: This Layer-1 expansion supports third-party DeFi apps, boosting its ecosystem and competitiveness.

Hyperliquid’s roadmap to becoming a standalone Layer 1 positions it to rival top blockchains. The platform’s swift response to the JELLY incident, enhancing security and transparency, reinforces user trust.

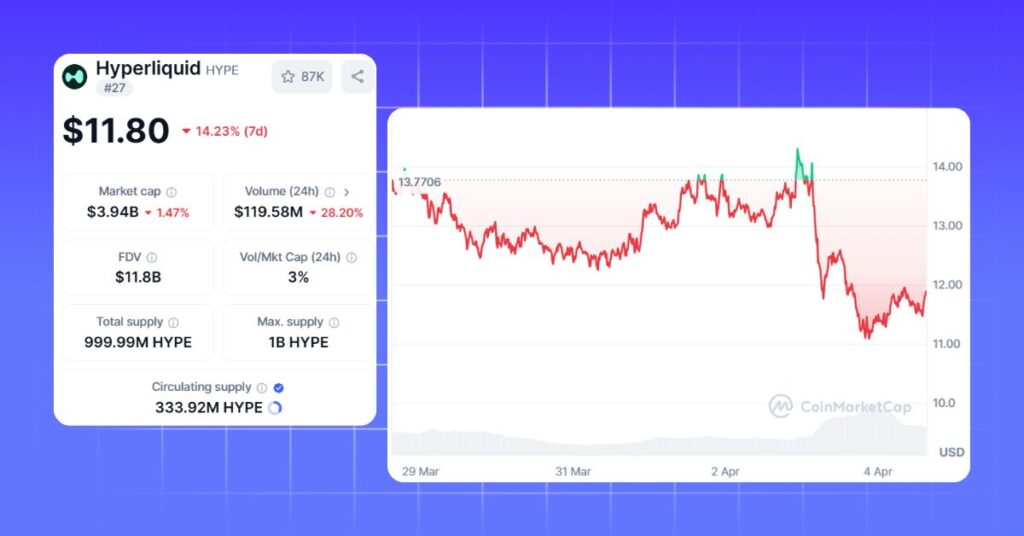

With daily perpetual futures volume soaring and $HYPE’s potential to exceed its $35.02 ATH, Hyperliquid remains a powerhouse in the derivatives space.

Hyperliquid is a must-watch for derivatives enthusiasts and blockchain innovators. Curious about its next move? Follow its journey to catch the upcoming investment wave!

- Web: https://mevx.io/@homepage

- Telegram: https://t.me/Mevx?start=homepage

Share on Social Media: