TLDR:

- Significant Loss: James Wynn, a prominent Hyperliquid trader, suffered a near $100 million loss on May 30, 2025, as his Bitcoin long positions were liquidated following a dip below $105,000.

- Market Context: Bitcoin’s price drop, influenced by tariff discussions from U.S. President Donald Trump, led to the liquidation of Wynn’s substantial leveraged bets, highlighting the risks of high-leverage trading in volatile markets.

On May 30, 2025, James Wynn, a well-known trader on the Hyperliquid platform, experienced a staggering loss of nearly $100 million as his Bitcoin long positions were liquidated after the cryptocurrency’s price fell below $105,000. The incident reminds us once more how dangerous and high-risk such trading can be when carried out using leverage.

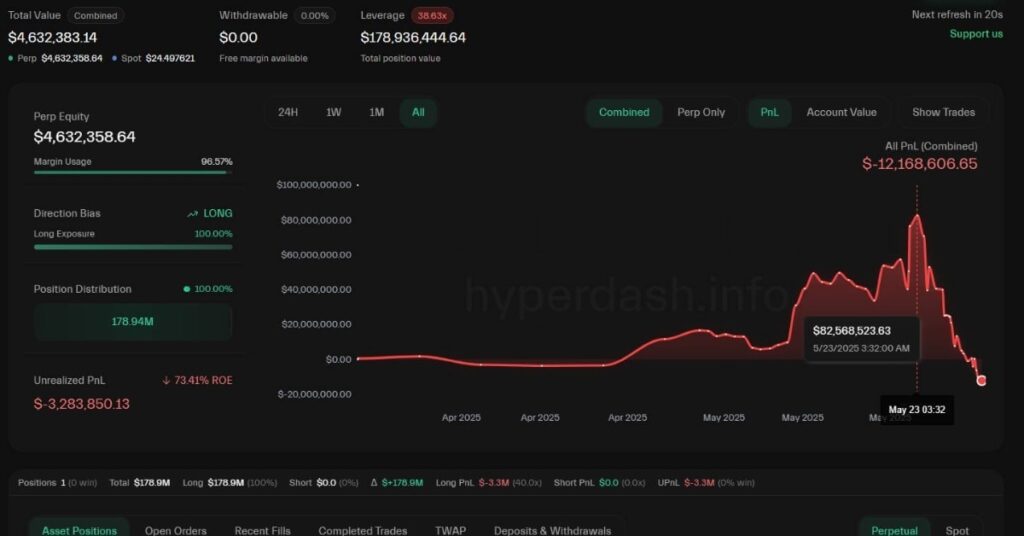

Wynn held not one but two huge long leveraged positions in Bitcoin (BTCUSD), expecting a price increase. According to on-chain information from analytics platform Hyperliquid’s tool, Hypurrscan, these positions had been closed for a total of $99.3 million. The first, 527.29 BTC valued at $55.3 million, closed when Bitcoin traded at $104,950. The second, 421.8 BTC valued at $43.9 million, closed when Bitcoin traded at $104,150. And then, on May 29, one of Wynn’s positions – a 94 BTC valued at $10 million – also closed at $106,330, contributing to overall losses. A total of 949 BTC had been closed, resulting in Wynn’s nearly $100 million losses over the course of a week.

The market conditions of such a liquidation are interesting. Bitcoin price wicked down to $104,630 through early trades on 30 May, and lower elsewhere. The move followed U.S. President Donald Trump’s renewal of tariff threats, applying downward pressure on the asset. Wynn had amplified his risk by constructing a 40x leveraged long Bitcoin position to $1.25 billion on 24 May, before accumulating massive losses after the market moved against him.

Read more news on the MevX Blog!

Share on Social Media: