The Solana ecosystem, once hailed as a high-speed rival to Ethereum, is currently navigating choppy waters. Over the past month, SOL, the native token of the Solana blockchain, has plummeted by nearly 28%, according to market data. This steep decline mirrors a broader bearish trend gripping the cryptocurrency market, but Solana’s struggles appear particularly pronounced, raising questions about the network’s resilience and long-term prospects. As traders eye their portfolios with growing unease, analysts are sounding the alarm: is the Solana ecosystem collapsing?

Is the Solana Ecosystem Collapsing? A Bear Market Squeeze

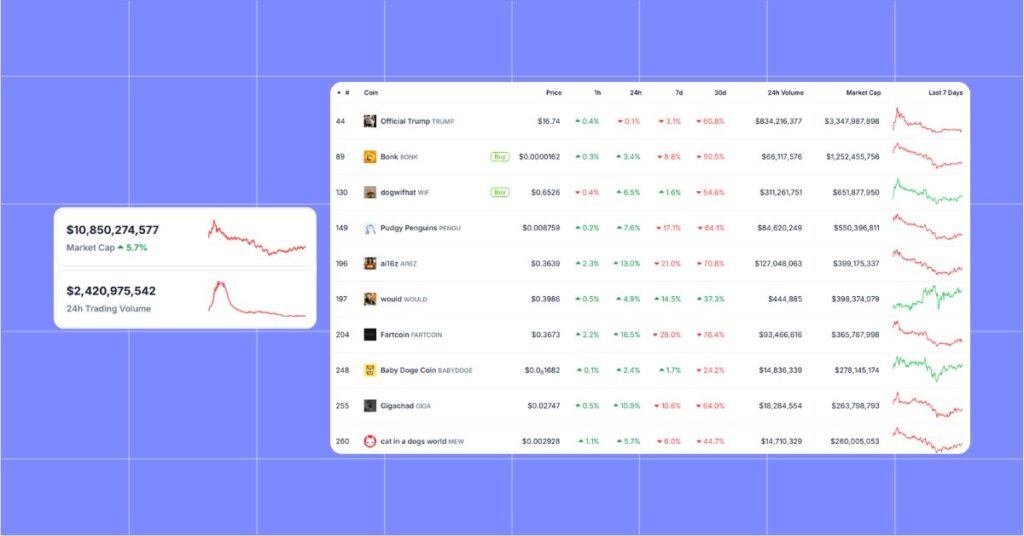

The past 30 days have been unkind to Solana and its associated tokens. The Solana ecosystem, which includes popular projects like Render (RNDR), Dogwifhat (WIF), Jupiter (JUP), Bonk (BONK), and others, has seen widespread declines. For instance, WIF has shed 54% of its value, BOME has dropped 50%, and even the relatively stable Jupiter has slipped by 15.9%. These figures paint a grim picture of an ecosystem caught in a relentless bear market, with no immediate signs of recovery.

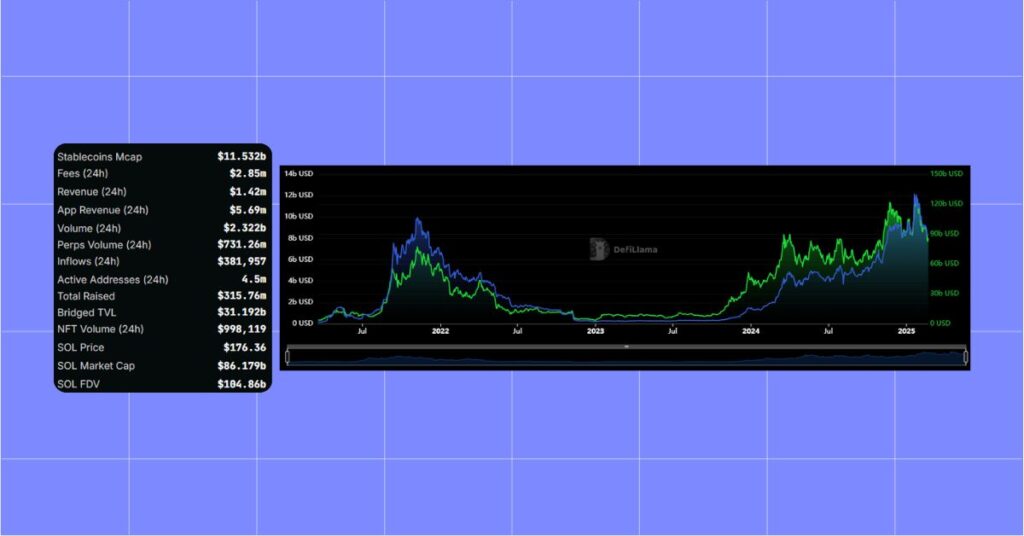

Analysts point to a combination of factors driving this downturn. Joao Wedson, founder of Alphractal, recently warned that Solana’s ecosystem could be at risk of a broader collapse if the bearish conditions persist. “The market is stuck in a rut, and Solana’s performance has lagged significantly behind Bitcoin,” Wedson noted, highlighting the network’s underperformance relative to the leading cryptocurrency. SOL’s market cap, which once soared to $151 billion, has now dwindled to $86 billion, a stark indicator of fading investor confidence.

Speculation and Hype: A Double-Edged Sword

One of the key issues plaguing Solana is its increasingly speculative nature. The Solana ecosystem has become a hotspot for memecoin mania, with tokens like BONK and WIF drawing in hordes of traders chasing quick profits. While this frenzy initially fueled growth, it has since spiraled into a volatile bubble. Whales and bots have capitalized on the hype, exacerbating market swings and leaving retail investors vulnerable to sudden crashes.

This speculative fervor has historical parallels. Networks that lean too heavily on hype often face liquidity crunches when big players cash out, abandoning smaller projects to wither. Many Solana-based tokens, sustained more by flash trading than organic development, now appear at risk of fading into obscurity. The question remains: can Solana pivot away from this boom-and-bust cycle to foster sustainable growth?

Network Activity Wanes

Beyond price woes, Solana’s on-chain metrics tell a troubling story. Transaction volumes on decentralized exchanges (DEXs) within the ecosystem have slumped since peaking in December 2024, signaling a drop in user engagement. Daily transaction counts have also fallen sharply, from a high of 71,738 on January 23 to just 9,303 by mid-February, according to blockchain analytics. This decline suggests that the network’s once-vibrant activity is cooling, potentially undermining demand for SOL.

The Total Value Locked (TVL) across Solana’s decentralized applications (dApps) has similarly taken a hit, reflecting reduced participation in its DeFi ecosystem. While Solana previously boasted record-breaking TVL figures, recent outflows, such as the $772 million in stablecoin exits reported earlier this month, highlight a flight of capital that could further destabilize the network.

The Memecoin Scandal Fallout

Adding fuel to the fire, Solana’s reputation has been tarnished by recent controversies. The LIBRA memecoin, linked to Argentine President Javier Milei, was exposed as a rug-pull scam, with ties to the same team behind MELANIA, a token promoted by U.S. First Lady Melania Trump. These high-profile scandals have cast a shadow over Solana, amplifying concerns about the prevalence of pump-and-dump schemes within its ecosystem. For traders, this erosion of trust could deter new investment and prolong the current downturn.

Figure out The Complete Timeline of the LIBRA Drama

Should Traders Worry?

For those holding SOL or eyeing a position, the outlook is murky. On one hand, Solana’s low transaction fees and high throughput remain compelling advantages, positioning it as a viable platform for future growth. Innovations like Firedancer, a new validator client aimed at boosting performance, and potential institutional adoption of real-world assets (RWAs) could eventually reignite interest. Posts on X also hint at optimism among some community members, with mentions of Solana capturing 94% of memecoin volume and surpassing DEX volumes across all chains combined.

Yet, the immediate risks are hard to ignore. Imminent token unlocks threaten to flood the market with additional supply, potentially driving prices lower. Coupled with declining stablecoin volumes and persistent bearish sentiment, SOL’s path to recovery looks fraught with obstacles. Technical indicators, such as negative funding rates and rising open interest in short positions, further suggest that traders are betting against a near-term rebound.

The Road Ahead

Solana ecosystem stands at a crossroads. Its ability to weather this storm will hinge on restoring user confidence, curbing speculative excesses, and delivering on its technical promise. For traders, the decision to hold or exit may come down to risk tolerance. While some see a buying opportunity in the dip, others caution that a “major reset” could be looming, a shakeout that separates the ecosystem’s winners from its casualties.

As the crypto market continues to evolve, Solana’s struggles serve as a reminder of the volatility inherent in altcoin ecosystems. Whether it can reclaim its former glory or succumb to mounting pressures remains an open question. For now, traders would do well to watch closely and proceed with caution.

Keep an eye on the Solana Ecosystem’s movement with MevX, and don’t forget to try MevX trading bot on multi-chain here:

Share on Social Media: