In the wild world of meme coins, few launches have been as chaotic as that of $PAIN, the cryptocurrency inspired by the viral “Hide the Pain Harold” meme. On February 19, 2025, the project, led by the meme’s figurehead “Harold” (András Arató, the Hungarian engineer behind the bittersweet smile), made headlines on X with a stunning admission: Harold accidentally locked his 50% share of $PAIN Lockup for 20 years, tying their release to his 100th birthday.

This blunder came amid a dramatic market cap plunge, from $2.1 billion to just $195 million in minutes, and a promise to refund 80% of presale funds. Meanwhile, parallels emerge with another Solana-based meme coin, HULEZHI, whose recent on-chain antics and price surge offer a fascinating comparison.

The $PAIN Lockup: An Accidental Lockup and Market Crash

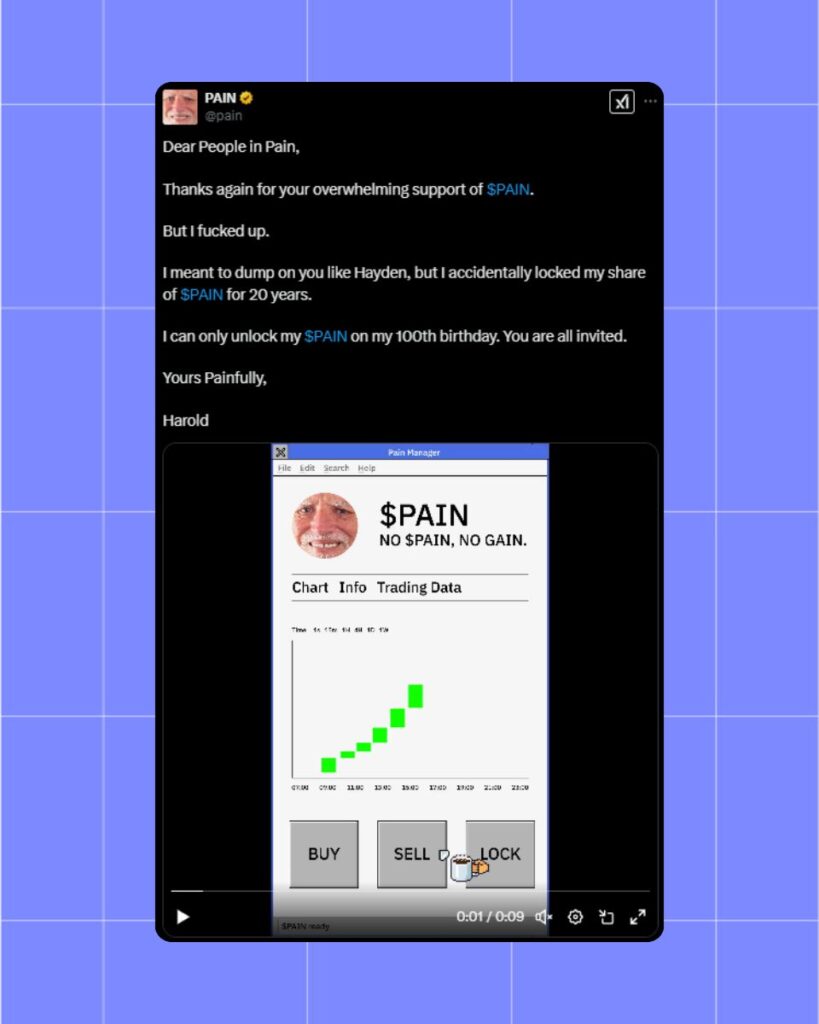

The story unfolded on X, where the @pain account posted on February 19, 2025, sharing an image of Harold, sporting his signature pained expression, sipping coffee while working on a laptop.

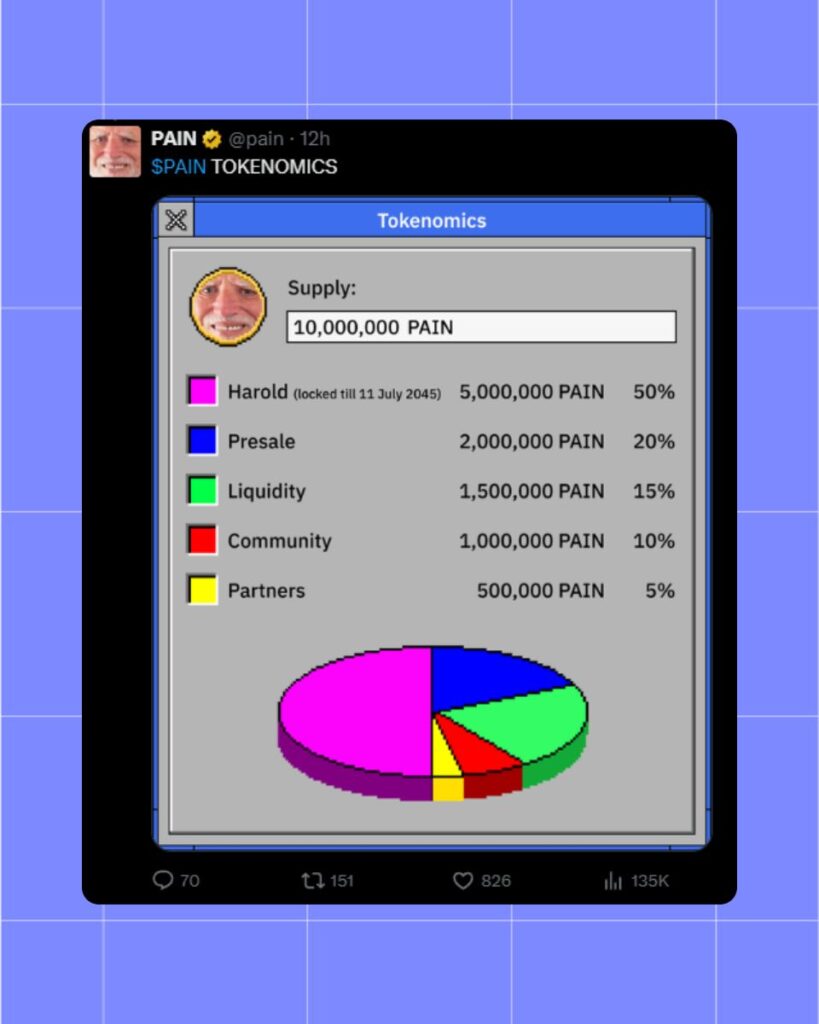

This confession came as $PAIN’s token experienced a staggering -83.06% price drop, according to subsequent X posts and web data from CoinMarketCap. Follow-up posts revealed a screenshot of Harold’s locked tokens, set to unlock on July 11, 2045, and tokenomics showing 50% of the 10 million $PAIN supply held by Harold, with the rest distributed among presale, liquidity, community, and partners.

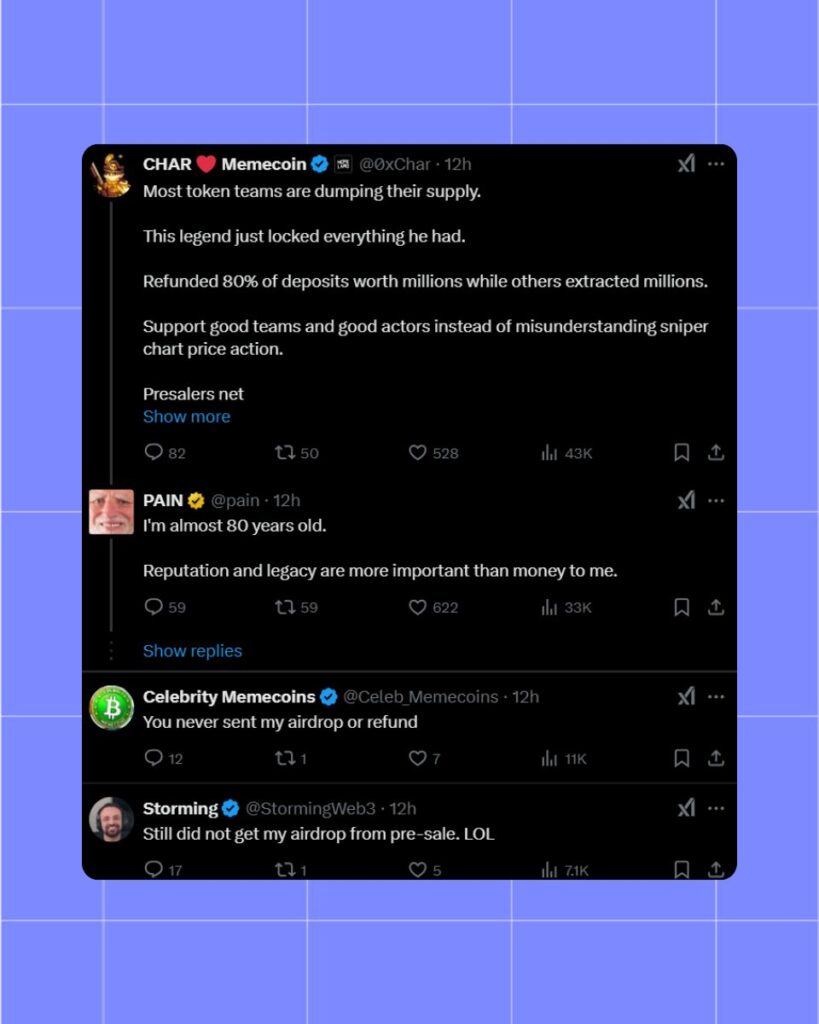

The project’s team also announced they had refunded 80% of the 185,976 SOL (Solana) raised during the presale, a move praised by some X users as transparent but criticized by others frustrated over delayed airdrops or losses. For instance, @0xChar tweeted, “Most token teams are dumping their supply. This legend just locked everything he had. Refunded 80% of deposits worth millions… Love you Harold,” while @meme_cycle complained, “You never sent my airdrop or refund.”

This volatility mirrors the broader meme coin frenzy of 2025, where low entry barriers and social media hype drive rapid rises and falls. However, Harold’s accidental lockup, intended as a “dump” like other meme coin projects, sets $PAIN apart, creating a narrative of unintended integrity amid a typically speculative space.

HULEZHI Parallels and Insights

PAIN story intersects intriguingly with HULEZHI, another Solana-based meme coin making waves. According to ChainCatcher web results from February 18, 2025, HULEZHI, tied to programmer Hu Lezhi, saw a dramatic on-chain event where Hu destroyed 500 ETH (worth $5.55 million) to protest “tech tyranny.” This action, documented on Etherscan, sparked speculation and drove HULEZHI market cap to $4.3 million, with its price reaching $0.043, up from a peak above $5 million.

Like PAIN, HULEZHI leverages a personal narrative for viral appeal. Hu Lezhi claims to have been monitored and manipulated by a “brain control organization” since birth, a story he etched onto the Ethereum blockchain. This mirrors Harold pained expression and accidental lockup, both serving as emotional hooks for their respective communities. HULEZHI token contract (0xc24d52e3d3a36e9481af0715180e530cbe4667ca) shows a circulating supply reacting to Hu on-chain messages, much like PAIN community response to Harold X posts.

PAIN operate on Solana, a blockchain known for its meme coin ecosystem, as noted in web results from CryptoNews (Solana second-largest by DeFi TVL in Q4 2024). HULEZHI recent surge on Ethereum, driven by Hu destruction of $5.5 million in ETH, parallels PAIN initial hype, but HULEZHI volatility (market cap fluctuation from $5 million to $4.3 million) echoes PAIN 83.06% crash. Crypto KOL Foobar commented on X, “Ethereum holders are so shocked by price fluctuations that they are sending millions of dollars to zero addresses for destruction,” linking HULEZHI dramatic move to broader market sentiment.

Shared Trends and Challenges

PAIN and HULEZHI reflect 2025 meme coin trends, as outlined in web data from Bitdegree.org and The Guardian. Both rely on social media hype, X posts for PAIN, on-chain messages for HULEZHI, and face volatility risks. PAIN refund initiative contrasts with HULEZHI lack of financial recovery for Hu destroyed ETH, but both highlight the speculative nature of meme coins.

Regulatory scrutiny, intensified by scandals like Argentina LIBRA (crashing in February 2025 after President Javier Milei withdrawal), looms over both projects. While PAIN team transparency (e.g., 80% SOL refunds) may shield it from LIBRA-style accusations, HULEZHI on-chain stunts risk regulatory backlash, similar to LIBRA “pump and dump” allegations.

AI and DeFi integration also play a role. PAIN accidental lockup suggests DeFi tool complexity, while HULEZHI Ethereum-based destruction showcases on-chain experimentation. Bitcoin dominance, rising to 59.56% in early 2025 per CoinMarketCap, pressures meme coins to rely on community-driven hype, a strategy both PAIN and HULEZHI employ.

What Lies Ahead

For PAIN, recovery hinges on community trust and Harold narrative. X posts show a mix of support (“Blessed,” @ppllz_) and skepticism (“Nah this is too painful,” @calibra82), but the 20-year lockup could attract long-term holders. Current price stabilization at $10.88 suggests a potential rebound, though liquidity remains a concern.

HULEZHI, meanwhile, faces uncertainty after Hu $5.5 million ETH burn. Its market cap drop to $4.3 million indicates waning hype, but the viral nature of Hu story, claiming “great pain” over digital enslavement, may sustain interest, mirroring Harold pained meme appeal.

Together, PAIN and HULEZHI embody 2025 meme coin madness, equal parts innovative, chaotic, and risky. As crypto markets grapple with regulation, AI tools, and Bitcoin dominance, these projects test the boundaries of hype-driven finance.

Further Reading

Embracing the Pain with PAIN Meme Coin

Escaping the Digital Matrix With HULEZHI Crypto Rebellion

The Complete Timeline of the LIBRA Drama

Share on Social Media: