Over the two days, cryptocurrency trading is a story of two extremes: The market king Bitcoin (BTC), which fell 12%, and Pi Network coin, which jumped from $0.60 to $2.60, a 333.33% spike. In general, whenever Bitcoin falls, the entire market falls with it, with altcoins red across the spectrum. But not Pi, a glaring exception, which went 4x in valuation in chaos. Let us look at Why Bitcoin is in a downward spiral and why Pi is not following suit.

Bitcoin’s Sharp 12% Drop: Why Is It Happening?

Bitcoin’s price has slumped from $95,000 to $84,000 over the last two days, a 12% decline that’s rattled the crypto community. Normally, when Bitcoin falls, it drags most altcoins down with it, and this time is no different—except for Pi. Here’s what’s driving Bitcoin’s downturn, with insights drawn from recent market analyses, including Finance Magnates’ report on BTC falling under $91K:

- Profit-Taking After a Rally: Bitcoin enjoyed a strong run in late 2024, hitting a peak of $109,000 in December. Over the last two days, investors appear to be cashing in on those gains, leading to heavy selling pressure. Posts on X note “whales” unloading BTC, suggesting large holders are locking in profits after a lucrative year.

- Market Correction and Stagnation: After nearly 90 days of trading between $91,000 and $102,000, Bitcoin’s momentum stalled. Finance Magnates highlights this range-bound behavior as a sign of market stagnation, leaving BTC vulnerable to a sharp drop when selling kicked in. The past two days saw this weakness materialize, with a 12% fall reflecting a broader correction.

- Institutional Outflows: A key factor Finance Magnates points to is the slowdown in institutional demand via spot Bitcoin ETFs. Over the last week ending February 21, outflows totaled $552.5 million, and this trend likely persisted into the last two days. Big investors pulling out or reallocating funds has added downward pressure on BTC’s price.

- External Economic Pressures: Trump’s tariff announcements on February 24, 2025—25% on Canada and Mexico, 10% on Chinese goods—sparked a risk-off sentiment across markets. The S&P 500 dropped 2.3% and Nasdaq 4% over five days, per Finance Magnates, showing Bitcoin’s growing correlation with traditional assets. Over the last two days, this macroeconomic unease has hit BTC hard, contributing to the 12% decline.

- Liquidations amplifying the Fall: The cascading effect of Bitcoin’s drop triggered nearly $1 billion in liquidations across the crypto market, with $57 million from BTC long bets alone in the last 24 hours, as noted by Finance Magnates. This wave of forced selling over the last two days has worsened the 12% plunge, pushing altcoins into the red alongside BTC.

When Bitcoin drops, it’s like a tide pulling the market down—most altcoins bleed red as investors flee riskier assets. X posts reflect this panic, with sentiments like “BTC’s crash is killing everything else.” Yet, Pi Network’s token has somehow sailed against this tide.

Pi Network’s 4x Surge: A Price Journey

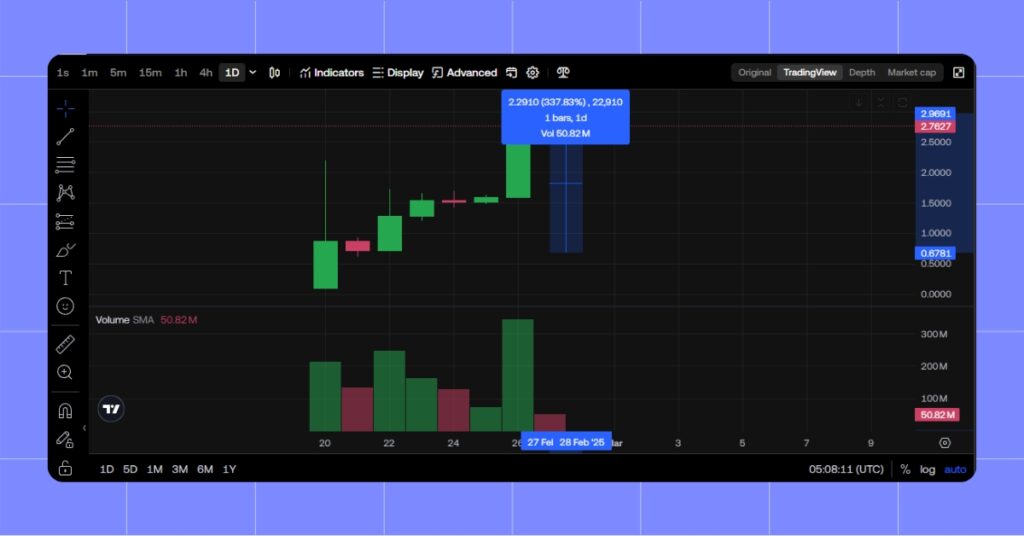

While Bitcoin itself and also the entire market crashed, Pi Network coin surged in a few days with a 4x surge from $0.60 to $2.60.

So, how is Pi Network coin flying high 4x as Bitcoin drops 12% and altcoins are in distress? Here is why:

- Capital Rotation: Bitcoin is 12% red as a portion is rotating into Pi, anticipating short-term appreciation. Funds from BTC have rotated into Pi because Pi is relatively cheap on a cost basis as well as a new attraction over a two-day basis with no altcoins appreciating much.

- Launch Hype Overriding Trends: Pi Open Mainnet launch opened floodgates on pent-up enthusiasm from its 60-million-member network. Breaking away from its altcoin counterparts whose success is linked to Bitcoin’s success, its new driver is powered by Pi, with users declaring “Pi’s community is powering this surge” in two days.

- Speculative Frenzy: Pi’s dramatic jump from $0.60 to $2.60 is a testament to speculation, its $1.2 billion daily trading a testament to interest. Other altcoins are hammered by a 12% fall in BTC, except that its volatility and newsworthy novelty attract buyers in, with X posts chronicling short-sellers becoming “liquidated” as it shoots up.

- Market Psychology Shift: Bitcoin’s 12% fall triggered fear (25 Fear & Greed Index), with investor interest moving in opposite directions towards BTC as well as traditional altcoins. Pi, in contrast, tells a different story, sucking in money as a sole exception in two days, as sentiments about X as “BTC’s loss is Pi’s gain” suggest.

A Market Anomaly

Typically, a 12% Bitcoin drop sends the entire market into the red, as altcoins follow BTC’s lead. Finance Magnates notes Ethereum fell 8.5% to below $2,500 and XRP 9% to $2.25 in a single day, mirroring this trend. Pi’s 4x surge is a rare defy, driven by its launch timing and community strength, making it a beacon of green in a sea of red.

Conclusion: A Tale of Two Days

Over the two days, Bitcoin’s 12% decline to $84,000 is laid at the doorsteps of profit-taking, outflow from institutions, and economic pressures that have brought most altcoins with it. But Pi Network coin is up from $0.60 to $2.60, a 333.33% jump, on its launch on its mainnet and speculation. But why is that? Pi independent power and money flowing from a fearful BTC market have made it a gem that is bucking a fall in a fall.

Check out other articles on the MevX Blog!

Share on Social Media: