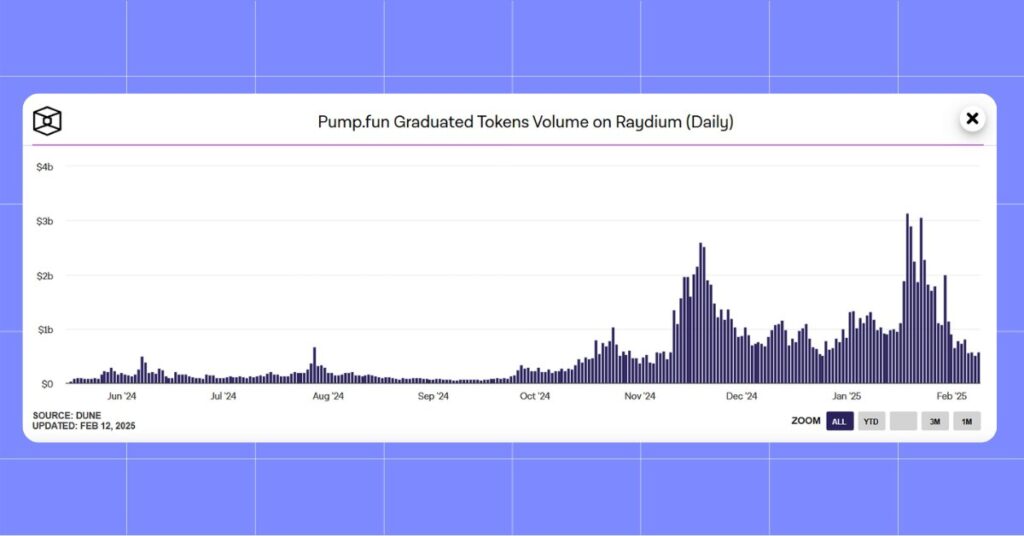

The on-chain trading on Solana, or more informally, the “trenches,” slowed in recent weeks. The trading of graduated Pump.fun tokens averaged just 560 million per day during the second half of last week, The Block’s metrics indicate. This is a low point in trading per day since Christmas of 2024 and a decline of 82% from three weeks ago’s all-time high of 3.13 billion.

A Decline in Token Graduations

Pump.fun, a social platform to list meme tokens on Solana, also saw a decrease in tokens that graduated to Raydium, a decentralized Solana network-based exchange. Tokens on Pump.fun that graduated to Raydium in the just-concluded week accounted for a mere 1.04%, a decrease from 1.54% in the previous week and 1.59% in the week before that. The graduation decline signifies a decline in interest in new launches of meme tokens and a more general slowing of speculative trading action.

Jito Validator Tips Reflect Reduced Trade Activity

Another indicator of the cooling market is the decline in tips paid to Jito validators on Solana. Last week, the daily average amount of tips stood at 23,800 SOL, or roughly $4.8 million. This is a significant drop from the previous two weeks, where tips averaged 42,000 SOL ($9.9 million) and 68,500 SOL ($17.5 million), respectively. Since tips are often used to bribe validators to prioritize transactions, this reduction is a clear sign of declining trade activity among users.

The “Euthanasia Coaster” of Solana Meme Coins

The recent trend in Solana meme coins can be likened to a “euthanasia coaster,” a metaphorical reference to a roller coaster designed to provide a series of intense highs and steep drops, with each subsequent rise and fall becoming progressively smaller. The first peak in this cycle was the $TRUMP meme coin, which reached a fully diluted valuation (FDV) of approximately $75 billion at its peak.

Following $TRUMP, a series of derivative meme coins launched, each with progressively lower market cap ceilings. $MELANIA, launched shortly after $TRUMP, peaked at an FDV of over $13 billion. This was followed by $VINE, a meme coin promoted by the founder of the Vine platform, which reached a market cap of nearly $500 million. A few days later, $jellyjelly, a Pump.fun coin launched by one of the co-founders of Venmo, peaked at a $250 million market cap. Most recently, $JAILSTOOL entered the scene, further illustrating the diminishing returns in the meme coin space.

What’s Behind the Cooling Trend?

The decline in trading volume and meme coin action on Solana is a function of a combination of factors:

- Fading Hype – The initial hyped-up fervor regarding such meme tokens as $TRUMP and their brethren already is beginning to die down, reducing speculation.

- Market Volatility – The entire cryptocurrency marketplace has been more volatile, making traders more cautious.

- Meme Coin Lifecycle – The natural boom-and-bust nature of meme tokens is possibly at a point of diminishing return, at least in the short term.

Looking Ahead

The current slowing of trading action and releases of meme tokens is unsettling, but it is a reflection of the natural ebb and flow of the cryptocurrency marketplace. Periods of excessive speculation always give way to cooling-off periods in order to provide more healthy expansion and new innovations to take hold.

For Solana, such decline would be a reset that would allow the network to focus on fortifying infrastructure and more serious endeavors beyond meme tokens. Sites like Pump.fun and Raydium would be obliged to adapt to changed marketplace needs in order to get trader interest going again.

The “euthanasia coaster” of Solana’s meme tokens is a reminder of the speculative nature of the cryptocurrency marketplace and of practicing more circumspection in moving up and down its ups and downs.

Share on Social Media: