In the complex world of cryptocurrency, events illustrate the interlaced threads of social psychology, financial speculation, and internet culture than meme coins. This article closely explores the intricate lifecycle of memecoins, examining how such digital assets evolve from social media jokes to billion-dollar market phenomena.

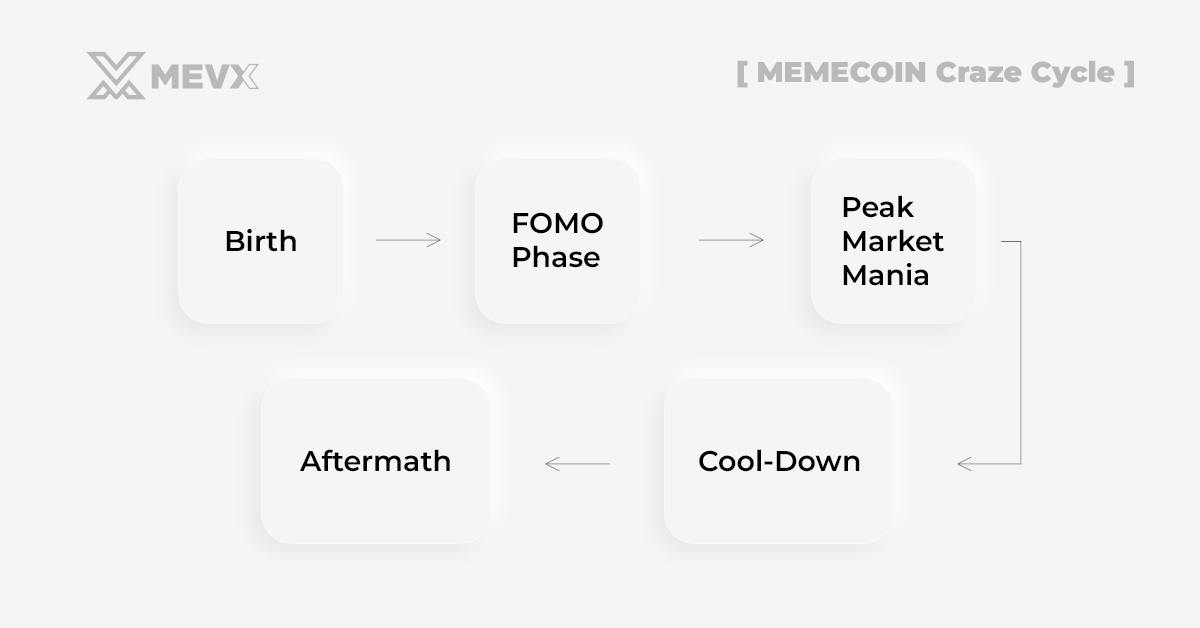

Memecoin Craze Cycle

Key Takeaways:

- Memecoins epitomize where social media culture meets cryptocurrency markets.

- Success is largely based on community engagement and market sentiment.

- Most memecoins trace a predictable life cycle from birth to evolution or extinction.

- Long-term survival requires evolution beyond the initial meme status

- Investment in memecoins carries significant risks due to their volatile nature

The Rise of Social-Driven Cryptocurrencies

“Memecoins have fundamentally altered how we view cryptocurrency adoption and community building,” says Alex Thompson, Chief Strategy Officer at Digital Asset Research. “What started as a joke with Dogecoin has evolved into a legitimate, albeit highly speculative, asset class.”

According to data from CoinGecko, memecoins booked cumulative trading volumes of over $1 trillion last year (2023), demonstrating remarkable market participation despite their unconventional origins.

The memecoin phenomenon has seen a remarkable resurgence in 2024, with Dogecoin once again leading the charge. Following Bitcoin’s new all-time highs and the approval of spot ETFs, Dogecoin saw a surge of over 100% in Q1 2024, demonstrating the cyclical nature of memecoin popularity during broader crypto bull markets.

Understanding the Five Stages of Memecoin Evolution

The journey of a memecoin unfolds through distinct phases, each shaping its rise and fall. These stages highlight the dynamic nature of meme-driven markets.

1. The Birth of a Memecoin: From Concept to Community

The story of every memecoin begins with a spark – usually a combination of clever marketing, social media presence, and community engagement. Unlike traditional cryptocurrencies that often start with comprehensive whitepapers and technical roadmaps, memecoins typically embrace simplicity and humor.

Memecoins typically emerge through one of two paths:

- Intentional Creation: Developers deliberately launch a token with meme-worthy characteristics

- Organic Evolution: A project starts as a joke but gains unexpected traction

The inception phase is all about building the bones of the project. A core community of early believers and early adopters is built, along with a focused social media presence on Twitter, Reddit, Telegram, and Discord for engagement. Develop a strong narrative to capture the imagination while developing the basic technical infrastructure, such as smart contract deployment and preliminary liquidity, required for this future growth.

Market Analysis:

- 90% of new meme tokens fail within the first month

- Successful launches usually have more than 1,000 wallet holders within 48 hours.

- Initial liquidity requirements average $50,000-$100,000

Case Study: Dogecoin’s Origins (2013)

Dogecoin was created in 2013 by Billy Markus and Jackson Palmer in a light-hearted response to Bitcoin, within a record three hours. Although it started as a joke, the Shiba Inu theme of Dogecoin took to the internet like wildfire and captured general interest. Smaller subcommunities on Reddit early on would often lead to its growth by primarily using it for tipping and charity, giving Dogecoin its character in the crypto world.

While 90% of new meme tokens still fail within the first month, established memecoins like Dogecoin have shown remarkable staying power. The 2024 bull run has seen Dogecoin maintain its position among the top 10 cryptocurrencies by market capitalization, suggesting that some memecoins can evolve into long-term market participants.

2. The FOMO Phase: Momentum Builds

Once the meme coin has initial traction, the Fear of Missing Out (FOMO) sets in. A characteristic of exponential growth in price and community size, success stories, price predictions, and all other viral content clog the social media platforms.

During this phase, trading volumes go through the roof, and a lot of new investors jump on board because they don’t want to be left out of “the next big thing.” Price appreciation turns parabolic, mentions on social media go through the roof, and community members start getting very aggressive in their advocating for the coin.

This hyped-up phase usually lasts for 2–4 weeks and has some interesting characteristics. Daily trading volumes can surge upwards by 500–1000%, social media mentions increase upwards of 10,000%, and exchange listing requests go up about 300%. These figures reflect the fervor and rapid expansion typical of this phase.

Example: PEPE Token (2023)

- Day 1 to Peak: 17,000% increase

- Wallet Holders: 0-100k+ in two weeks

- Market Cap: $0 to $1.6 billion

Case Study: Shiba Inu (SHIB) 2021 Explosion

These combined factors culminated in the explosive growth of Shiba Inu in 2021. Pitted against an initial supply of 1 quadrillion tokens, SHIB peaked at more than $14 billion in daily volume. In one year, the price rose over 45,000,000%, and the community went from a few thousand holders to millions, a real testament to the powerful combination of social proof, FOMO, and community-driven viral marketing.

2024 Dogecoin Resurgence: A New Chapter

The 2024 bull run has revitalized the memecoin sector, with Dogecoin standing out as a symbol of the sector’s resilience. This resurgence has been fueled by several key factors. The integration of Dogecoin as a payment method on X (formerly known as Twitter) has significantly boosted its visibility and utility. Renewed interest from Elon Musk, known for his influence in the cryptocurrency space and his ventures, has added momentum to the coin’s appeal. Additionally, growing institutional acceptance has legitimized Dogecoin as more than just a meme, attracting serious investors. Finally, a general bullish sentiment across the crypto market has further amplified Dogecoin’s popularity, setting the stage for its continued success.

Success stories serve as social proof that attracts new investors hoping to make similar gains. FOMO psychology further propels people to invest in its hype for fear of missing out on profits. Community expansion is another contributory factor, with thousands of new members joining up in response to growing popularity. Viral marketing amplifies this effect because a community of owners will create and share memes, further fueling engagement and visibility.

5 phases of memecoin cycle

3. Peak Market Mania: The Zenith of Hype

At the peak of a memecoin, even mainstream media can’t resist covering it. This is where the project has the most visibility and usually its highest valuations. This phase is a mix of opportunity and risk.

Specific characteristics include the following: the major exchanges list the coin for better accessibility and credence. Celebrity endorsements-for instance, Elon Musk’s tweets Dogecoin-increase visibility and hype. Mainstream media starts covering this phenomenon, bringing it to an even bigger audience. This is a period of extreme volatility in price, going hand in hand with huge engagement over social media and record-high volumes, which get driven by excitement about the coin.

Market Indicators:

- Maximum daily trading volatility (±50%)

- Peak social media engagement

- Highest retail investor participation

- Maximum market capitalization

Case Study: PEPE (2023)

The PEPE meme coin took off so aggressively that, in a matter of weeks in 2023, it had grown to a market capitalization of $1.6 billion and was listed over 100 times on exchanges, while attracting over 500,000 holders and global mainstream media advertising the token.

Other historical data also point out that: Dogecoin reached a peak market cap of $88 billion in 2021, while Shiba Inu was also hot on its heels, with a peak market cap of $41 billion this year. These figures shed light on the explosive growth that meme coins have seen in recent years.

4. The Cool-Down: Reality Sets In

Inevitably, mania ends. Early investors start reaping profits, and the early excitement diminishes. This is where the real test of ruggedness hits the project and the community.

Once the hype of the meme coin starts to wear off, the price is taken into a cool-down phase where the price corrections start to become frequent and the trading volume consistently goes downwards. Media attention soon moves away, and community interest wanes. Any underlying project fundamental, if they are there, sees scrutiny here.

Typical in this phase is market behavior with retracements of 50-90% from the peak, gradually decreased trading activity, holder distribution change towards whale increased concentration, and a community sentiment change from euphoria to concern as the excitement wears off.

Technical Aspects

- Liquidity Reduction

- Decreased Network Activity

- Lower Gas Fees (for network-specific tokens)

- Trading Pair Consolidation

During a cool-down for a memecoin, several statistical trends become very clear. The prices usually retrace 60-90% from the all-time highs, reflecting the speculative momentum lost. Daily trading volume falls about 70%, reflecting investor activity. The number of active wallet addresses falls by about 40%, reflecting user engagement. These rather hot trends reflect the natural cooling period following the peak mania of a coin.

“This phase separates sustainable projects from temporary phenomena,” explains Dr. Michael Roberts, Cryptocurrency Economics Professor at Stanford University. “Only about 5% of meme coins successfully transition to sustainable projects.”

Case Study: BONK (2023-2024)

In December 2023, this suddenly surged by 4,800% and became highly talked about. However, such hype was followed by a correction of 70% in upslope to bring it down. The downturn did not deter the BONK community from shifting its focus to utility development for the long-term growth of the coin. Utility integration with the Solana ecosystem was supposed to further advance its use case in the blockchain space.

5. The Aftermath: Evolution or Extinction

In the final phase, it is time to decide whether the crypto meme coin will survive as an established member of the crypto ecosystem, evaporating into thin air. Few managed to live their survival past this phase into established projects.

Their survival may be due to:

- Continued community engagement

- Development of proper use cases

- Integration into larger crypto ecosystems

- Maintained liquidity and trading volume

- Evolution beyond the initial meme status

That is why Dogecoin is one of the very few success stories still relevant years from creation and found real use cases in tipping and micropayments.

Following the Price Volatility Indicators, the daily average price movement ranges between 20-30%, highlighting substantial volatility. During peak volatility periods, price moves can be as high as 100% in a single day.

While the timing of the exact entry point is important, the trader must also take into consideration necessary risk management operations such as stop-loss orders. Adequate portfolio allocation allows diversification in security, and a well-defined exit strategy protects one’s gains while managing risks in such a volatile market.

Conclusion

The meme coin phenomenon is a peculiar combination of social media culture, cryptocurrency technology, and mass psychology. As it usually goes, most of the meme coins eventually sink into obscurity, but their impact on the whole cryptocurrency ecosystem has been immense. They showed the strength of community-driven projects, and how decentralized movements can really create substantial market value.

Share on Social Media: