The saga of Test Token (TST) continues to demonstrate the undisputed unpredictability of the cryptocurrency world. Initially designed as an educational device, TST has transformed into a fable about the strength of the community, the impact of influential people, and the speculative characteristics of meme coins. This article attempts to analyze TST further, especially about Changpeng Zhao (CZ), the former CEO of Binance, and his unexpected role in this narrative.

The Genesis of TST

The BNB Chain team authored an instructional guide that came with a Test (TST) module. Its purpose was to familiarize users with meme coin creation and deployment on the Binance Smart Chain (BSC) using the Four.meme launchpad. However, it became even more interesting on February 6, 2025, when CZ, quite happily, started sharing the TST on his social networks and generated buzz around it.

In the community, TST was known as the tool developed for beginners. For the first time, it was intended as a portrayal of how meme coins are minted, managed, and administered, and as such, it was never intended to have any underlying value. Unfortunately, for TST, the crypto world functions a bit differently. After the perception of value came to be associated with TST, it was only a matter of time before chaos ensued in the community after its announcement.

The CZ Effect

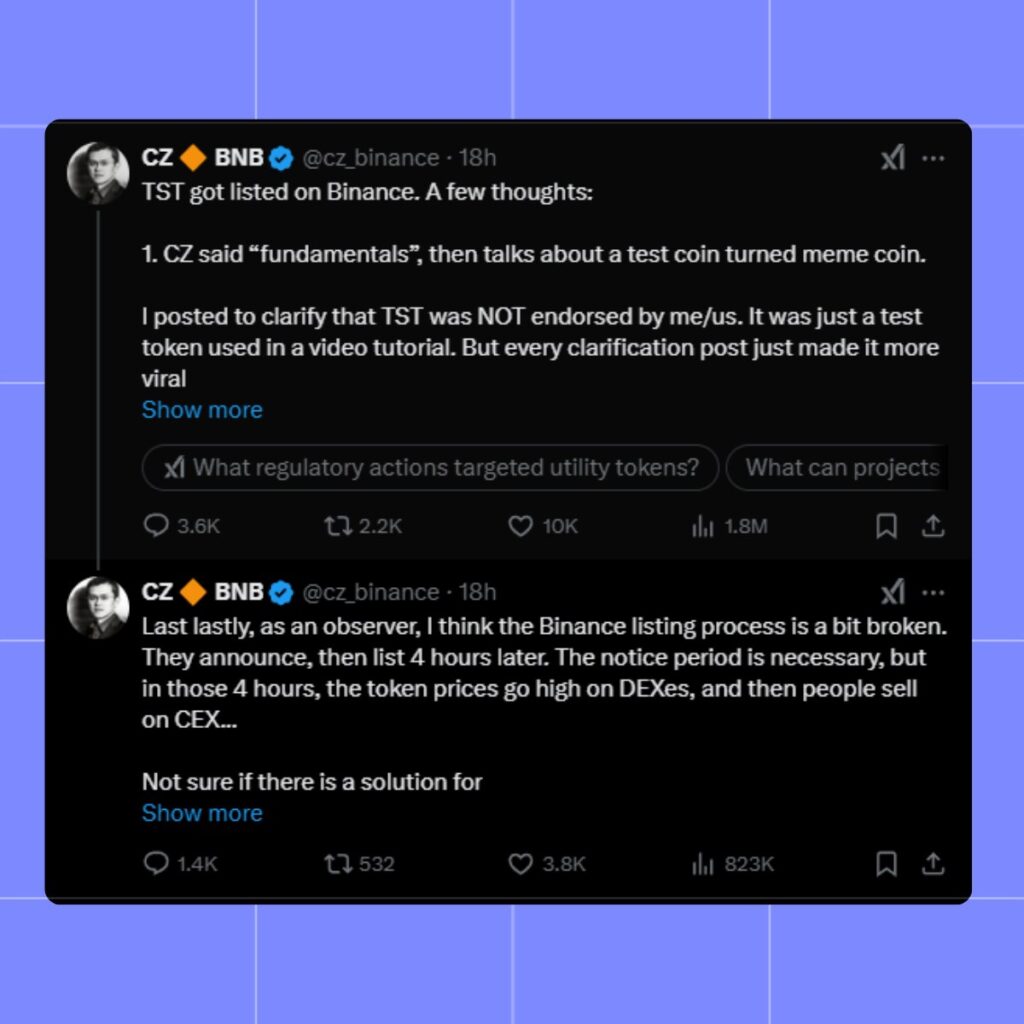

CZ, one of the significant voices in the crypto world, took to X (previously Twitter) to explain that the TST in question was only a test token for an educational video. The aim was to clear any potential confusion or misunderstandings. As a result, his clarification post resulted in Test Token receiving heightened attention as opposed to TST on the 6th of February, 2025, at 11 PM PST.

Test Token’s market cap grew to almost $52 million within minutes, with TST being actively bought by many users, especially in the Chinese crypto market. This was worsened when a couple of KOLs started to market TST on social media platforms. What was supposed to be a warning transformed into marketing, which caused a lot more people to invest.

CZ later made follow-up posts on the situation, claiming that the frenzy had gone viral without intention. Each post that was trying to clarify made the situation worse and spoke of how there was never any intention of putting TST into circulation. He kept saying that Test Token was never an official project and that he or the BNB Chain team possessed any of the tokens. Interest in TST must have been strong because no one ever came out to shooting down the claim.

CZ’s Stance on Meme Coins

CZ has never been a strong advocate for meme coins. He has publicly stated that he has not invested in any meme tokens, noting, “I haven’t bought a single meme coin yet.” However, he also acknowledges their role in the broader crypto ecosystem.

Although CZ does not personally interact with meme coins, he does appreciate their attraction. It has also been pointed out that the increased regulatory attention on utility tokens may be steering some investors towards meme coins, which are less compliant. Also, he has underscored the community’s role in value creation even without any core utility.

CZ constantly cautions investors regarding the negative impacts that meme coins can have, especially their underlying speculative nature. TST is a prime example of how a token can lose its original purpose and still see its value increase because of the hype around it.

Market Impact and Community Response

Test Token’s meteoric rise is a classic example of the crypto market’s mercurial nature. Volumes erupted within minutes of CZ’s tweet, and liquidity pools were filled in minutes as speculators scrambled to ride the wave. The market cap, which began at a humble $400,000, rose to a peak of $52 million before settling down at around $31.5 million.

The community reaction was mixed. Some loved it as a wonderful example of organic market behavior, while others saw it as a reminder of how quickly speculation can get the better of fundamentals. Many investors invested in it for nothing more than the hope of short-term profits, while others were drawn by the sheer novelty of the event.

As with most meme coins, liquidity was an issue. With the high market cap, effective liquidity was low, and it was hard for large holders to sell without affecting the price substantially. This is a typical problem with tokens that grow quickly in popularity but have poorly defined tokenomics.

Lessons and Implications

The rise of TST offers several takeaways for the crypto industry. First, it highlights the power of social media and influential figures in driving market trends. A single tweet from CZ—meant to downplay speculation—had the opposite effect, proving that perception is often more powerful than intention.

Second, it underscores the speculative nature of meme coins. Unlike traditional assets that derive value from earnings or utility, meme coins are often valued based on hype and community sentiment. This makes them highly volatile and risky investments.

Regulators may also take notice of events like Test Token. The ease with which a test token turned into a multi-million-dollar asset raises questions about investor protection and market manipulation. While crypto is largely decentralized, incidents like these could prompt increased scrutiny from regulatory bodies.

From an educational standpoint, TST ironically fulfilled its purpose. While it was initially meant to teach users how to launch a meme coin, it ended up demonstrating how quickly speculation can turn an experimental token into a full-fledged market sensation.

Conclusion

At this stage, Test Token is still an asset without any formal backing, thus making it particularly useful for this community. It is up to the investors, however, whether it retains value or simply fades away. Historical evidence suggests that meme coins do not retain value and either ruin cultural phenomena like Dogecoin or vanish without a trace.

While some traders believed that Test Token still had traction, others have long abandoned it for the next slam dunk. As TST does not seem promising in its origins from a new perspective, it still provides a captivating glimpse into how cryptocurrency markets work in real life.

Find similar helpful articles on the MevX Blog!

Share on Social Media: