On March 12, 2025, a single trader turned $15 million in USDC into a $4.36 million profit, while Hyperliquid, a decentralized crypto exchange, ended up $4 million in debt, covered by its HLP Vault. This wild event has people talking about how leverage works in decentralized finance (DeFi) and what it means for platforms like Hyperliquid. How did this trader pull it off with so little starting cash? Let’s break it down step by step for beginners.

The Context of The $4M Debt of Hyperliquid

Hyperliquid is one of the decentralized exchanges where you can trade cryptocurrencies like Ethereum (ETH) with leverage. Leverage lets you borrow funds for the purpose of investing in bigger positions than your funds would allow. With $15 million of funds, for example, you can manage a $300 million position with 20x leverage. It’s a high-risk game with great returns. If the price goes in your favor, you win big.

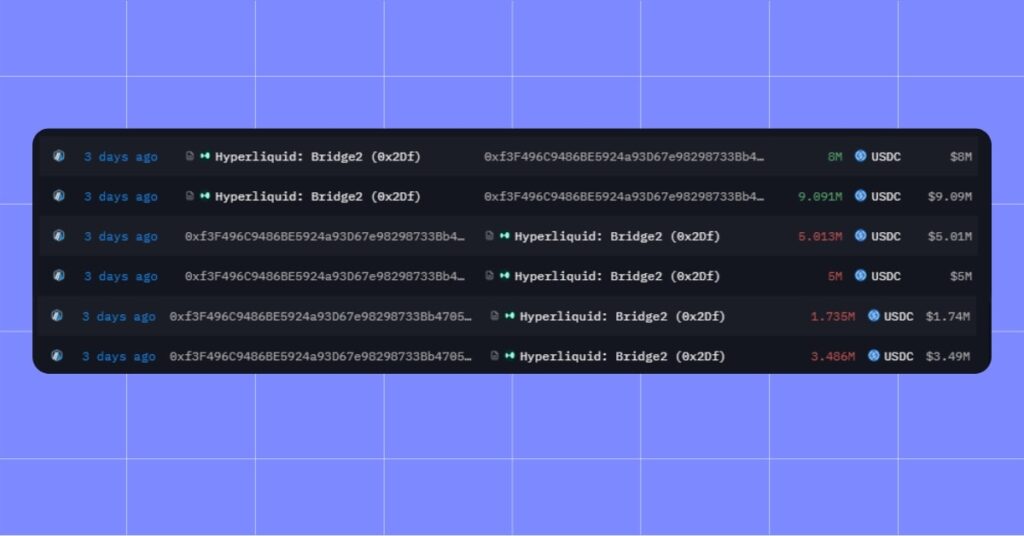

To mitigate such risk, Hyperliquid makes traders put up “margin,” some of their own funds as a cushion. If one of their trades incurs too large a loss, they liquidate it (sell it off) to cover the borrowed funds. Hyperliquid’s cushion is the HLP Vault, a kitty fund that steps in when liquidations are not enough or traders cannot cover losses. A trader who employed the 0xf3F496C9486BE5924a93D67e98298733Bb47057c wallet caused a $4 million loss to the HLP Vault on March 12, 2025, and walked off with a profit. Here’s how it unfolded.

How Did the Trader Act?

This trader’s moves were calculated and bold. Let’s walk through what happened on March 12, 2025, based on the details we have.

- Opened a Massive Long Position: The trader started with $15.23 million in USDC and used Hyperliquid’s leverage to go “long” on $300 million worth of ETH. Going long means betting the price will rise. With only $15.23 million of their own money, this implies leverage between 13.5x and 19.2x. For context, DeFi platforms like Hyperliquid let users amplify their trades this way, but it’s a tightrope walk. Small price drops can wipe you out.

- Early Success with ETH’s Rise: At some point, ETH’s price increased, and the trader made serious gains. Reports say they once profited $8 million from a similar move. This shows they knew how to ride an upward wave. During this upswing, they locked in profits by selling 15,000 ETH (worth about $28.95 million at a peak of $1,930 per ETH) and withdrew $17.09 million in USDC, netting $1.86 million profit from that part of the trade.

- Withdrew Margin Before the Fall: Here’s where it gets clever. After taking those early profits, the trader didn’t leave their full margin in place. In leveraged trading, margin acts like a safety cushion. If the price drops too far, Hyperliquid uses it to cover losses. At one point, after some time, this “whale” (a nickname for a big trader) had unrealized profits of about $8 million. Seizing the moment, they started pulling USDC out of their account. However, withdrawing $17.09 million USDC drastically lowered the margin ratio, the percentage of their own money backing the $300 million position. This left the position exposed with little collateral, triggering Hyperliquid’s automatic liquidation system to step in and restore balance. By withdrawing most of their $17.09 million, they set the stage for what came next.

- ETH Price Dropped and Triggered Liquidation: ETH’s price fell to $1,839 per coin. With insufficient margin, Hyperliquid had to liquidate the trader’s remaining position, 160,234 ETH, tied to the $300 million bet. Liquidation happens when a platform sells off a trader’s assets to repay the loan. The trader’s earlier profit-taking had pushed the liquidation price to $1,839, meaning Hyperliquid would step in at that exact level.

- HLP Vault Took Over: Hyperliquid’s system forced the HLP Vault to buy those 160,234 ETH at $1,839 each, costing $286 million. This is standard in DeFi. When a trader’s margin can’t cover a loss, the liquidity pool absorbs it. But the timing was brutal. ETH’s price dropped to $1,814 almost immediately after. The HLP Vault’s new ETH stash lost value fast, going from $286 million to about $282 million, a $4 million hit.

In short, the trader rode ETH’s rise, cashed out early profits, and left Hyperliquid holding a sinking bag when the price fell. The $4 million loss came because the HLP Vault had to buy ETH at a high point ($1,839) just as the market dipped ($1,814), a classic issue in fast-moving crypto markets known as slippage.

How Did the Trader Make Money?

The trader didn’t just stop at $1.86 million. They turned this event into a $4.36 million haul with three key plays.

Step One: Profiting from the Long

Before the drop, they bought 175,000 ETH at $1,884.40 each. When ETH hit $1,930, they sold 15,000 ETH, withdrew $17.09 million USDC, and pocketed $1.86 million in profit. This was their reward for catching ETH’s climb.

Step Two: The Liquidation Setup

Their remaining $300 million position (160,234 ETH) got liquidated at $1,839, costing Hyperliquid $4 million when ETH fell to $1,814. The trader didn’t earn directly from this, but by withdrawing margin earlier, they avoided losing their own money and shifted the burden to Hyperliquid.

Step Three: Shorting the Dip

While Hyperliquid was busy, the trader shorted 100,000 ETH at $1,839 on another platform, betting the price would fall. They knew that the liquidation of their massive $300 million position, equivalent to 160,234 ETH, would push ETH’s price down, so they placed this short on another platform to capitalize on it. When ETH dropped to $1,814, they closed the short, earning $2.5 million (100,000 x $25 profit per ETH). Combined with the $1.86 million from Step One, their total profit hit $4.36 million.

Hyperliquid’s $4 million loss wasn’t the trader’s gain. It was a side effect of their strategy. They made money on ETH’s rise and fall, while Hyperliquid paid the price for the liquidation mishap.

Is Hyperliquid Safe?

Was this a planned attack? The trader clearly understood Hyperliquid’s mechanics. The HLP Vault covers big liquidations, and low margin plus market timing can force it to act. They withdrew their margin, shorted ETH elsewhere, and triggered a costly liquidation. It wasn’t a hack, just a smart (or ruthless) use of the system.

Hyperliquid responded by cutting ETH’s max leverage from 50x to 25x, hoping to limit such risks. But how bad was the $4 million loss? The HLP Vault is worth $451 million, so this is only 1% of its value. Compared to Hyperliquid’s past $60 million in profits, it’s 6.6%. It’s a dent, not a collapse. Similar events have hit other DeFi platforms like GMX, where traders exploit liquidations to profit while pools take losses. This wasn’t a flaw in Hyperliquid’s code. It’s a known risk in leveraged trading.

So, Is It Done?

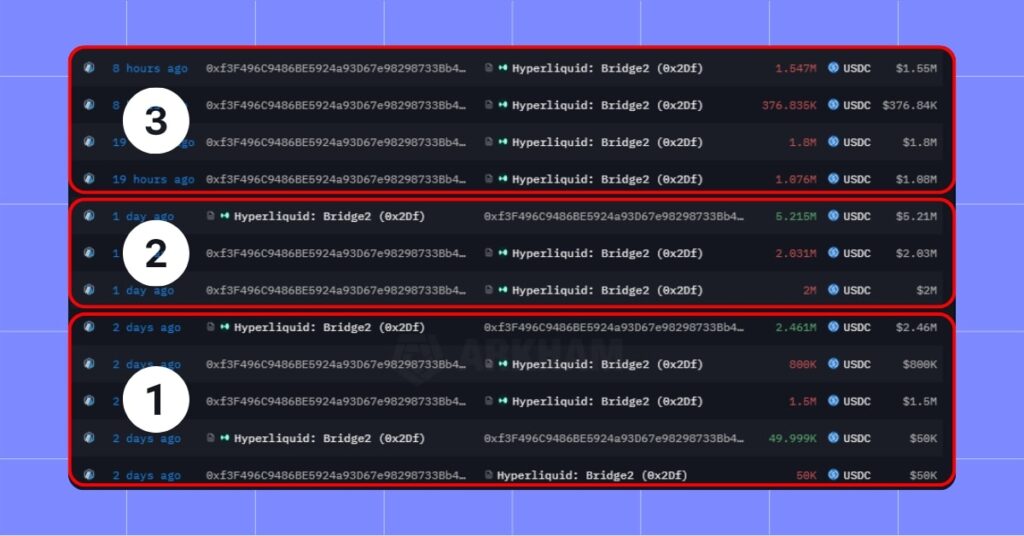

No, it’s far from done. After this successful “experiment” on March 12, the trader didn’t stop. Data from their wallet shows they repeated this process three more times. As of March 15, 2025, they’ve earned an additional $1,345,000 and are currently on their third round of this strategy. Was this a planned attack? The trader clearly understood Hyperliquid’s mechanics. The HLP Vault covers big liquidations, and low margin plus market timing can force it to act. They withdrew their margin, shorted ETH elsewhere, and triggered a costly liquidation. It wasn’t a hack, just a smart use of the system.

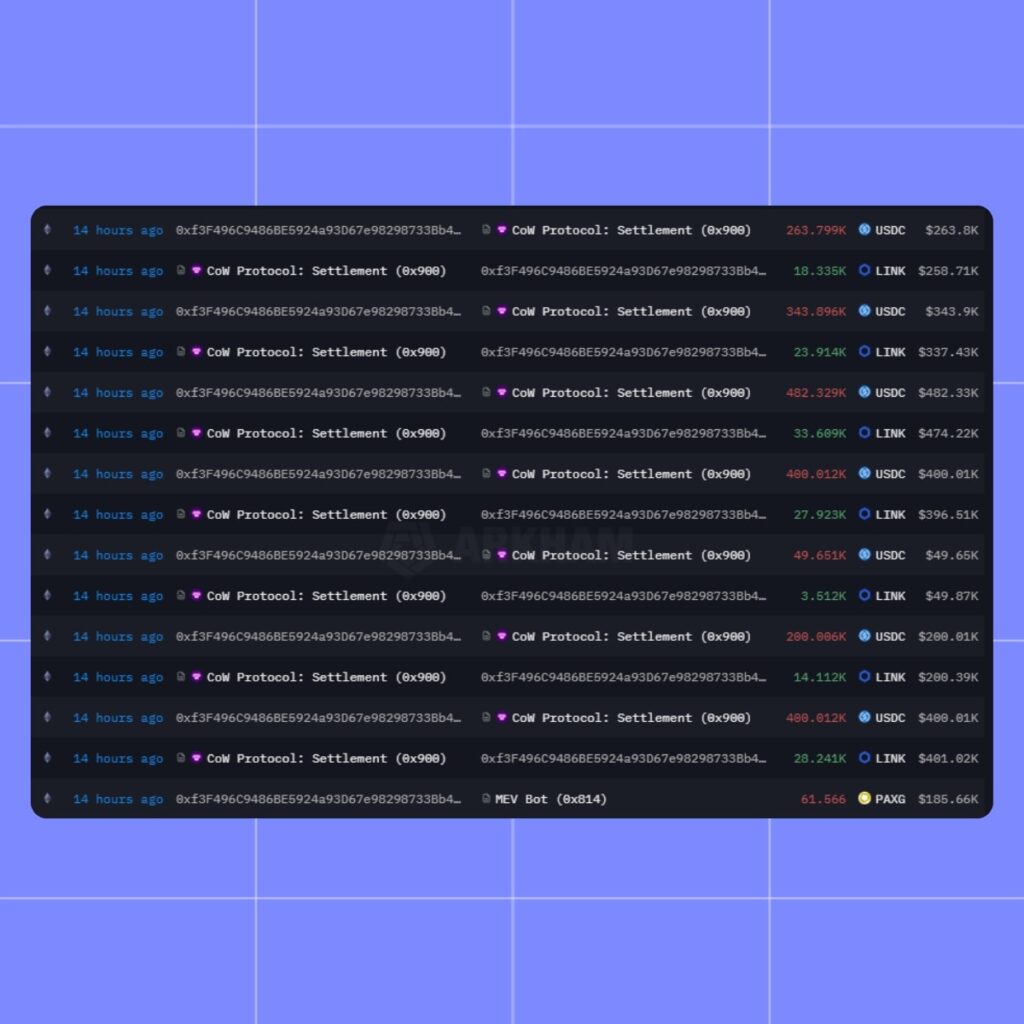

Now to LINK? After 2:00 PM UTC+0 on March 14, 2025, the trader shifted focus, buying 149,727 LINK tokens with $2.3 million ($185,660 in PAXG and $2.13 million in USDC).

Six hours later, at 8:00 PM UTC+0, they began selling all the LINK in multiple transactions. Based on this behavior, it looks like they might be manipulating LINK’s market, possibly to set up a short order and profit from a price drop, similar to their ETH strategy.

Wrapping Up

With just $15.23 million, this trader turned Hyperliquid’s leverage into a $4.36 million win, leaving the platform with a $4 million loss. They played the long game, cashed out early, and bet against ETH at the perfect moment. For beginners, it’s a lesson in how DeFi’s high stakes can reward the savvy and sometimes sting the system.

Find more Hyperliquid articles on the MevX Blog!

Share on Social Media: