Trump crypto projects are making headlines, blending political influence with digital finance in ways that intrigue investors and regulators alike. With the Trump administration championing crypto deregulation, initiatives like World Liberty Financial (WLFI) and American Bitcoin (ABTC), spearheaded by Donald Trump’s sons, Eric and Donald Jr., have delivered staggering gains followed by steep corrections.

These Trump crypto projects briefly inflated the family’s wealth by billions, but the volatility has ignited discussions on risks, ethics, and potential conflicts.

Trump Crypto Projects: World Liberty Financial’s WLFI Token

Trump crypto projects kicked off with World Liberty Financial, a DeFi platform aimed at bridging traditional and decentralized finance:

- Project Overview

- Launched in early September 2025, WLFI serves as the governance and utility token, enabling treasury allocation voting, token emissions, and holder incentives.

- The Trump family controls about 22.5 billion tokens (22.5-25% of total supply) via DT Marks DeFi LLC, with insiders and treasury holding another 29% and 16.6%.

- Notable backers include Justin Sun ($75 million for 3% stake) and the UAE’s Aqua 1 Foundation ($100 million). Total fundraising hit $550-750 million, directing 75% of presale revenue to Trump entities.

- Initial Surge

- Debuting at $0.30-0.46 on exchanges like Binance and Coinbase, WLFI skyrocketed due to hype, reaching a market cap of nearly $6 billion.

- This surge temporarily boosted the Trump family’s crypto assets to $5-6 billion, highlighting the lucrative potential of these Trump crypto projects.

- Dramatic Decline

- Within 24 hours, the token crashed over 50%, falling to $0.21-0.23 amid whale dumps totaling $698 million.

- By September 3, it hovered at $0.22-0.246, down 12-16% from launch, with related Trump-themed tokens like $TRUMP dropping up to 88%.

- Recovery Measures

- To stabilize prices, the team burned 47 million WLFI tokens (worth $11.34 million, or 0.19% of circulating supply) and approved a buyback-and-burn program using protocol fees.

- Community proposals include early unlocks, while partnerships with Nasdaq-listed ALT5 (Eric Trump on the board) and exchanges like HTX add credibility.

- Additional Details

- The platform’s $1.5 billion crypto treasury, invested in assets like ETH, wBTC, and Aave, has incurred $110 million in losses from market dips. Initially non-tradable, WLFI enabled secondary trading in mid-2025, fueling pre-market 10x gains in OTC deals.

American Bitcoin’s Nasdaq Debut: From 110% Gains to Pullbacks

Following WLFI, American Bitcoin emerged as another high-profile entry in Trump crypto projects, focusing on Bitcoin mining and reserves:

- Company Background

- Co-founded in March 2025 by Eric and Donald Trump Jr., who own ~98% (Eric’s 7.5% stake valued at $500-548 million post-debut).

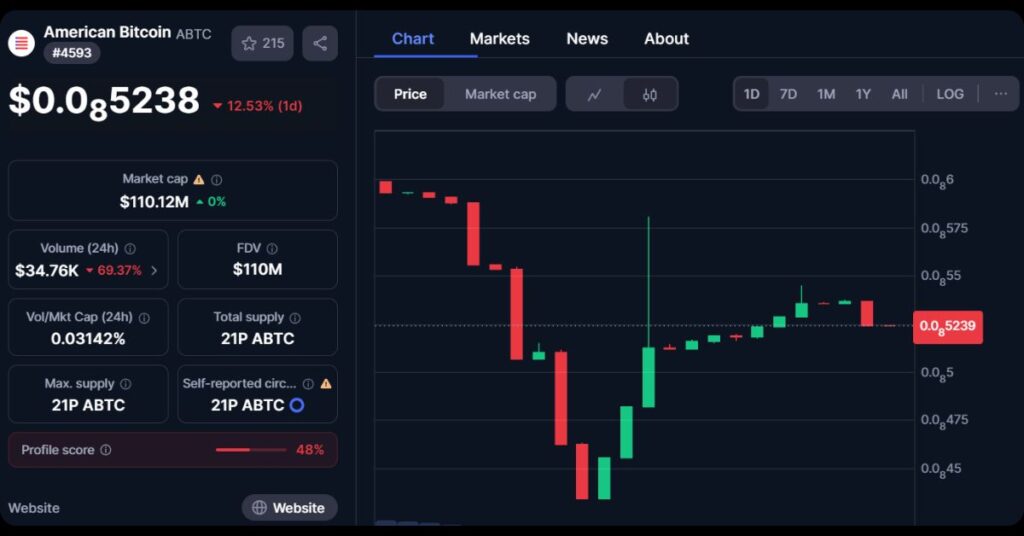

- ABTC merged with Gryphon Digital Mining and listed on Nasdaq under ticker ABTC on September 3, holding ~2,443 BTC worth $273 million to build the U.S.’s largest Bitcoin reserve.

- This was the second Trump-linked crypto listing that week.

- Explosive Debut

- Shares opened at $6.90-8 and surged 60-110% to $13-14 highs, with trading halted twice for volatility.

- The rally aimed for a $2.1 billion market cap, driven by investor excitement over Trump crypto projects amid deregulation buzz.

- Subsequent Pullback

- Despite the peak, ABTC closed up 16-42% at $9.50-9.80, reflecting a light correction but still above opening levels.

- The surge made Eric Trump a billionaire independently, adding billions to family gains.

- Operational Insights: High trading volumes sustained interest, but concentrated supply and whale activity pose risks, mirroring patterns in other Trump crypto projects.

Key Concerns Surrounding Trump Crypto Projects

These ventures underscore the intersection of crypto and politics, but they come with notable challenges:

- Conflicts of Interest: The Trump administration’s push for laws like the GENIUS Act (easing SEC oversight) and COIN Act (banning presidential token promotions) raises fears of favoritism, especially with 56% of WLFI supply controlled by insiders.

- Market Risks: Volatility from whale dumps, low liquid floats, and potential rug-pulls threaten retail investors in Trump crypto projects.

- Regulatory Scrutiny: Connections to figures like Justin Sun (SEC charges paused) and perks such as Mar-a-Lago access fees amplify ethical questions, with community views on X split between 10x upside predictions and scam warnings.

In summary, Trump crypto projects like WLFI and ABTC exemplify the sector’s thrill and peril, potentially transforming the family’s fortune while navigating regulatory minefields.

For deeper dives into Trump crypto projects and market shifts, follow our MevX blog for exclusive updates and analysis.

Share on Social Media: