On February 28, 2025, a dramatic confrontation unfolded in the Oval Office between U.S. President Donald Trump and Ukrainian President Volodymyr Zelensky, this Trump-Zelensky White House Clash sent shockwaves through global markets including the volatile cryptocurrency sector. What began as a diplomatic meeting to discuss a potential critical minerals deal and peace negotiations in the Ukraine-Russia conflict quickly devolved into a public shouting match, with Trump and Vice President JD Vance accusing Zelensky of ingratitude for U.S. support, and Zelensky firing back with pointed criticisms of Trump’s diplomatic approach. The fallout, captured live by the media, saw Trump eject Zelensky from the White House, scrapping a joint press conference and leaving the minerals deal in limbo. As of March 1, 2025, this high-profile clash is stoking uncertainty, with significant implications for the cryptocurrency market already riding a rollercoaster of Trump-driven expectations.

The incident comes at a pivotal moment for crypto. Since Trump’s re-election in November 2024, digital assets like Bitcoin have soared, propelled by his campaign promises to make the U.S. the “crypto capital of the planet.” Bitcoin hit a record $109,071 in January, fueled by Trump’s pro-crypto executive orders, including creating a cryptocurrency working group and hints at a national Bitcoin stockpile. Meme coins tied to Trump, such as $TRUMP, also spiked, with the token surging from $6.50 to $73 in days. Investors saw Trump’s administration as a golden ticket for deregulation and mainstream adoption, starkly contrasting the Biden era’s regulatory crackdowns. But the Trump-Zelensky blowup has injected fresh chaos into this narrative, raising questions about geopolitical stability and Trump’s ability to deliver on his ambitious agenda.

The Impact of Trump-Zelensky White House Clash

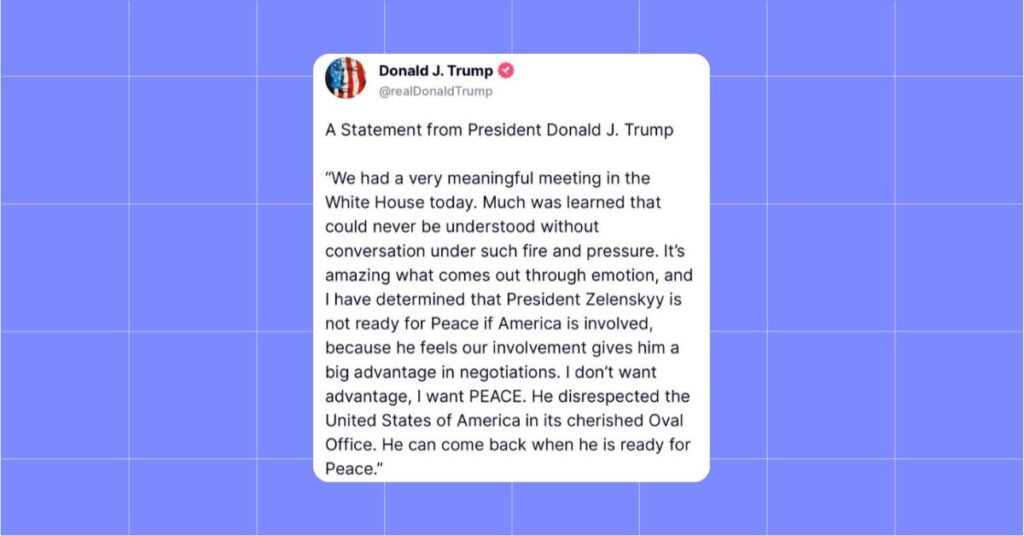

Crypto markets thrive on sentiment, and geopolitical tensions are a notorious trigger for volatility. The White House spat has already rattled investors. On February 28, Bitcoin dipped slightly, hovering around $106,000, while smaller coins like Ethereum saw sharper fluctuations. Analysts warn that the incident could signal broader instability. Trump’s hardline stance, evident in his Truth Social post labeling Zelensky “not ready for Peace if America is involved”, hints at a potential shift in U.S. foreign policy that could unsettle global trade and energy markets, both of which crypto is increasingly sensitive to. If Trump doubles down on isolationism or escalates tensions with allies, risk-off sentiment could dominate, pushing investors toward safe havens like gold and away from speculative assets like crypto.

The abandoned minerals deal adds another layer of complexity. Ukraine’s rare earth minerals, potentially worth $1 trillion, were eyed as a strategic asset for U.S. tech and energy sectors industries crypto relies on for infrastructure like mining hardware. A stalled deal could disrupt supply chains, indirectly pressuring crypto profitability. Moreover, Trump’s insistence that American taxpayers “get their money back” from Ukraine aid suggests a fiscal tightening that might clash with his freewheeling crypto promises. If budget priorities shift away from digital asset innovation to offset foreign aid costs, the much-hyped “Trump bump” could fizzle.

Crypto’s chaos isn’t just about external shocks, it’s also internal. The market’s euphoric highs have been tempered by skepticism over Trump’s meme coin ventures, criticized for ethical murkiness, and his tariff threats against Canada, Mexico, and China, announced days earlier. These tariffs, enacted on February 4, sparked an 8% drop in total crypto market cap, underscoring how Trump’s unpredictable policy swings can whipsaw digital assets. While some bulls argue his crypto-friendly appointees like SEC nominee Paul Atkins will keep the rally alive, others see a bubble ripe for bursting if geopolitical or economic headwinds intensify.

As March 2025 begins, the Trump-Zelensky clash is a stark reminder that crypto’s fate under Trump hinges on more than just deregulation. It’s tied to his volatile leadership style, global relations, and the messy interplay of politics and profit. For now, traders are bracing for turbulence, with Bitcoin’s next move hinging on whether Trump can steady the ship or steer it into choppier waters.

Stay ahead with MevX for more updated news!

Share on Social Media: