World Liberty Financial blacklists Justin Sun‘s wallet. This move has frozen billions in tokens and sparked accusations of market manipulation, leaving investors questioning the project’s decentralized ethos. As WLFI‘s price swings wildly, many are wondering: Is this a safeguard or a sign of deeper issues?

World Liberty Financial Blacklists Justin Sun’s Wallet: Key Details

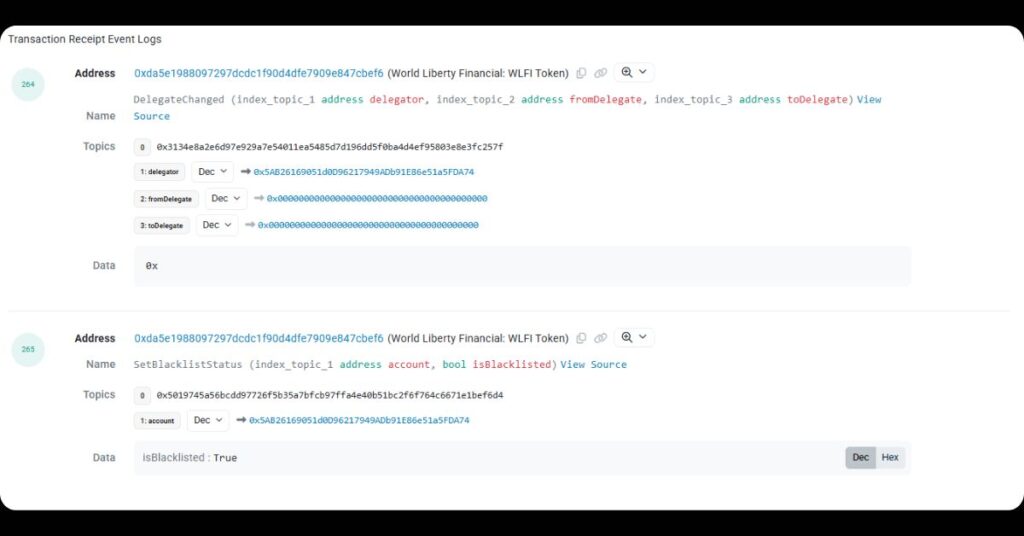

World Liberty Financial blacklists Justin Sun‘s Ethereum address, which came after on-chain data revealed suspicious transfers.

Here’s a breakdown of the core facts:

- Token Freeze: Approximately 595 million unlocked WLFI tokens, valued at around $107 million, were immobilized, along with an additional 2.4 billion locked tokens under vesting schedules, pushing the total frozen assets to nearly $900 million.

- Triggering Event: The blacklist followed the wallet’s transfer of approximately 50 million WLFI tokens, worth roughly $9 million, to cryptocurrency exchanges, raising concerns about potential dumping.

- Accusations: WLFI‘s team claims an exchange, widely speculated to be HTX (formerly Huobi, where Sun serves as an advisor), has been using user-deposited tokens for covert sales to suppress the token’s price.

- Sun’s Involvement: As a major investor who reportedly poured $75 million into WLFI and holds a significant stake, Sun’s actions have drawn scrutiny, especially given the project’s high-yield offerings (up to 20% APR) designed to attract deposits.

This isn’t the first controversy for WLFI, which aims to provide blockchain-based financial services but has faced criticism for its centralized controls.

Market Reaction and Broader Implications

Following the transfers, WLFI‘s price plummeted by about 16-20%, dipping to as low as $0.167. However, the blacklist announcement triggered a partial rebound, with the token climbing back above $0.18 as selling pressure eased. In response, the project burned 47 million tokens to tighten supply, but volatility remains high.

Justin Sun quickly denied any wrongdoing on X, stating the transfers were merely “general exchange deposit tests with very small amounts” and involved no actual buying or selling. Despite this, blockchain records confirm the wallet can no longer move WLFI tokens, highlighting the power project teams hold in “decentralized” ecosystems.

The event highlights ongoing concerns in crypto: the balance between centralized interventions and true decentralization, and the risks associated with exchange involvement in token dynamics. With WLFI‘s market cap hovering around $4.9 billion and a fully diluted valuation of $18 billion, analysts warn of potential further drops if trust erodes.

As the dust settles, this saga serves as a reminder of the high-stakes drama in DeFi. For more in-depth crypto insights and updates, follow our MevX blog today!

Share on Social Media: