President Donald Trump has warned of imposing significantly larger tariffs on the European Union (EU) and Canada if they attempt to harm the U.S. economy, raising concerns about instability in the cryptocurrency market.

What Happened as Trump Threatens Larger Tariffs?

In a Trump’s Truth Social post early Thursday (Asian hours), Trump stated, “If the European Union works with Canada to do economic harm to the USA, large-scale tariffs, far larger than currently planned, will be placed on them both to protect the best friend that each of those two countries has ever had!” He also claimed America’s “Liberation Day” is nearing, ending years of being “ripped off” by other nations.

This follows Trump’s earlier imposition of 25% tariffs on imports from Canada and Mexico, and a 20% levy on Chinese goods, citing national security concerns. The new tariff threats could raise import costs, and fuel inflation, and pressure the Federal Reserve (Fed) to tighten monetary policy, negatively impacting risk assets like bitcoin (BTC), XRP, and Dogecoin (DOGE). A stronger U.S. dollar might further suppress BTC prices as investors shift to safe havens like gold or cash.

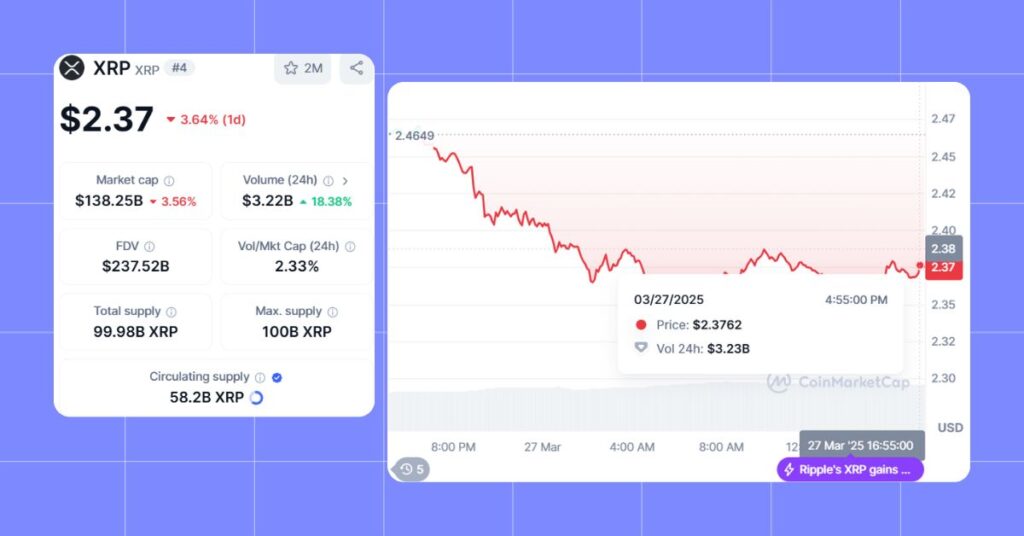

The crypto market showed mixed reactions. Post-Trump’s statement, XRP and Solana (SOL) dropped 2%, while Dogecoin, which had gained 3.5% in the prior 24 hours, saw its momentum fade.

Ether (ETH) and BNB remained largely unchanged. Meanwhile, SUI from Sui Network surged 7%, boosted by the upcoming Walrus Network protocol launch.

Despite the uncertainty, some experts remain optimistic. Jupiter Zheng of HashKey Capital suggested that pro-crypto regulations in Asia could drive the next bull market. Jeff Mei from BTSE believes the worst may be over for crypto, with prices potentially rising as U.S. inflation fears ease.

Traders are now eyeing the Personal Consumption Expenditure (PCE) data will be released on March 28, which will influence Fed interest rate decisions.

Fresh updates, hot news. MevX delivers it all! Stay tuned!

Share on Social Media: