The recent $YU stablecoin depeg incident has sent ripples through the DeFi community, highlighting vulnerabilities in even the most promising protocols.

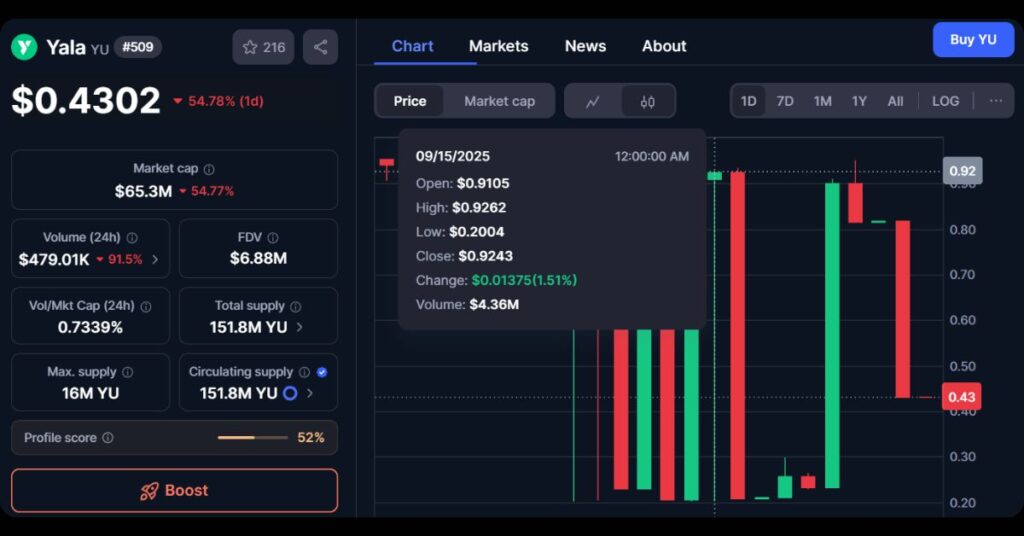

On September 14, 2025, Yala’s $YU stablecoin, a Bitcoin-backed asset designed for over-collateralized stability, faced a severe exploit that caused its value to drop from $1 to as low as $0.11. As the dust settles on September 15, questions about recovery and future safeguards are mounting.

$YU, launched by the Yala protocol, operates across multiple chains, including Polygon, Bitcoin, and Ethereum. It’s positioned as a “Bitcoin-native” stablecoin, aiming to bridge traditional crypto assets with DeFi applications.

Details of the YU Stablecoin Depeg Attack

The attack unfolded around 5:14 UTC+8 on September 14, when an exploiter targeted a vulnerability in Yala’s minting and bridging processes on the Polygon chain. By minting an unauthorized 120 million $YU tokens, the attacker flooded the market, dumping them for USDC and converting to approximately 1,501 ETH, valued at about $7.7 million at the time. This massive sell-off caused the $YU stablecoin to depeg, plummeting its price by up to 89% and disrupting liquidity pools.

Key aspects of the exploit include:

- Method of Attack: The hacker exploited flaws in the protocol’s convert and bridge functions, allowing illicit token creation without proper collateral.

- Immediate Impact: Trading volumes spiked over $50 million due to panic selling, while exchanges like KuCoin and Phemex issued warnings and paused YU transactions.

- No Direct User Losses: Yala assured that user funds remained safe, with no wallet hacks reported, though liquidity providers bore the brunt of the depeg.

- Market Reaction: Discussions on platforms like X (formerly Twitter) compared it to past depegs, such as Terra’s UST, fueling debates on the risks of BTC-backed stablecoins.

Yala’s Response and Path to Recovery

Yala’s team acted swiftly, halting convert and bridge features to contain the damage. They’ve partnered with blockchain security firm SlowMist for a thorough audit and investigation.

By September 15, $YU had partially recovered to $0.79-$0.92, with commitments to fully reimburse affected pools and enable 1:1 redemptions for USDC.

Looking ahead, a Web3 executive noted in related analyses that stablecoin tickers like $YU may evolve. Future designs could simplify user interfaces to display just “USD,” with AI handling backend swaps and peg maintenance, potentially reducing such risks.

This $YU stablecoin depeg underscores broader DeFi challenges: the need for rigorous audits and diversified collateral. As the crypto market eyes upcoming events like the Fed’s rate decisions, incidents like this remind investors of inherent volatility.

For more in-depth crypto insights and updates on the $YU stablecoin depeg saga, follow our MevX blog today!

Share on Social Media: