Maximal Extractable Value (MEV) has emerged from a rather niche term to the centerpiece in discussions around Ethereum and DeFi. MEV refers to the additional profit created by selecting which, or more accurately, not to include in a block, or in what order to include transactions before validation. MEV is effective at bringing efficiency to the Ethereum network and fueling incentivization across it; however, it calls for ethical debates and regulatory questions. Understanding MEV shall be key as blockchain ecosystems start to mature in presenting opportunities and challenges. This article will take you through understanding MEV.

The Historical Evolution of MEV

MEV has been a part of Ethereum since the genesis block. Early on, this took the shape of miners extracting extra profits via transaction ordering. As DeFi emerged, so did a new set of MEV opportunities arbitrage, liquidation, and more complicated strategies like sandwich attacks. Ethereum’s transition from proof-of-work (PoW) to proof-of-stake (PoS) in 2022’s Merge shifted the responsibility for MEV extraction from miners to validators. This does not mean, however, that the principles of transaction prioritization for profit have changed.

Validators are now reliant on specialized builders and searchers to optimize the blocks-creating a new hierarchy within the MEV ecosystem. This transition demonstrates that MEV keeps changing with consensus mechanisms and infrastructural shifts in Ethereum.

Explore Ethereum: The ‘World Computer’ Transforming Blockchain and Finance

The Role of Mempools in MEV Dynamics

Understanding MEV requires comprehension of how mempools work. Mempools are temporary pools used to store unconfirmed transactions that have yet to be added to the blockchain block. While traditional financial systems often rely on the principle of first-in-first-out, blockchain mempools do not; they are flexible, and builders can reorder the transactions in order to maximize their profit.

Things are further complicated by the existence of both public and private mempools. While anyone has access to the public mempool, not everyone has access to a private one. This creates an unfair environment, as private mempools could be used to further strategies such as front-running, where privileged players have an advantage over regular participants.

This is where regulators try to apply the traditional finance lens to blockchain and face a real challenge: mempools are dynamic and decentralized, the exact opposite of conventional market structures, making oversight and policy enforcement quite complicated.

MEV: A Driving Force in DeFi

At its core, MEV is the financial engine that powers DeFi. It plays a crucial role in ensuring market efficiency. For example, MEV facilitates arbitrage opportunities that keep prices aligned across decentralized exchanges and supports the liquidation of undercollateralized loans, preserving protocol stability.

However, unchecked MEV introduces risks. Practices like front-running, back-running, and sandwich attacks can harm users and destabilize markets. In April 2023, a significant vulnerability in a relay system allowed attackers to manipulate block validation, extracting millions within seconds. Incidents like these highlight the need for robust safeguards against MEV exploitation.

Current Challenges in the MEV Ecosystem

Today, MEV’s influence extends beyond validators to other key players, such as builders and searchers. Builders assemble transactions into blocks, optimizing them for MEV, while searchers identify profitable opportunities. These roles often overlap, creating a concentrated power structure that can challenge decentralization.

This concentration raises ethical and practical concerns. When a few actors dominate the MEV supply chain, it threatens Ethereum’s foundational principles of openness and fairness. Furthermore, private order flows, where certain players gain exclusive access to transaction data, can create unfair advantages and invite scrutiny under market manipulation regulations.

Regulatory and Ethical Implications

As MEV practices become increasingly sophisticated, so do the regulatory eyes they attract. Such creative strategies include sandwich attacks and oracle manipulation, which make it very confusing to distinguish between innovation and abuse. It means that regulators, such as the U.S. Securities and Exchange Commission (SEC) and the European Securities and Markets Authority (ESMA), will study if MEV forms market abuse under various regimes such as MiCA.

Private transactions present some unique challenges as well. These practices may fall into gray areas of insider trading or fraud by allowing the actors to exclude or reorder transactions for profit. The legal ambiguity surrounding MEV needs urgent resolution to balance the scale between innovation and market integrity.

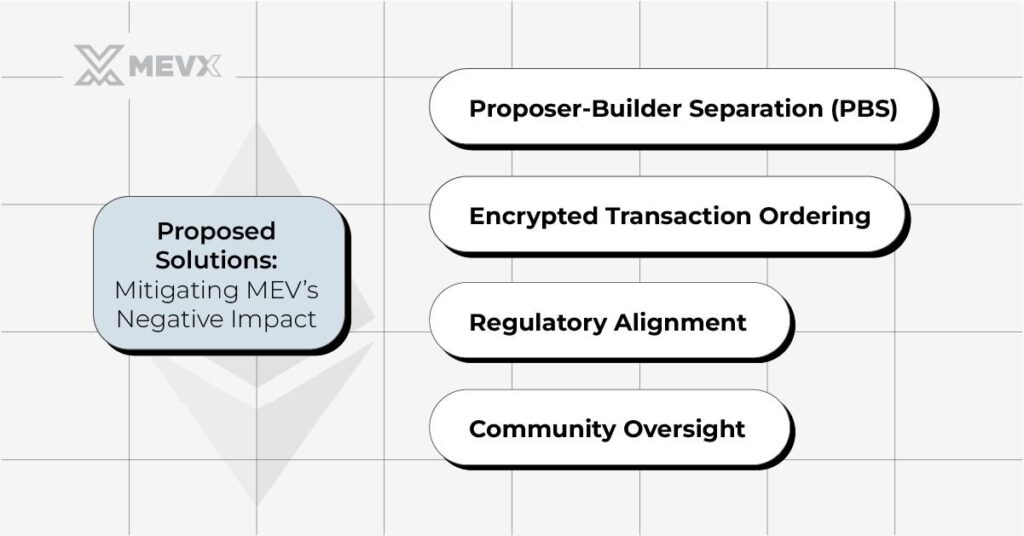

Proposed Solutions: Mitigating MEV’s Negative Impact

Addressing the challenges of MEV requires a multi-faceted approach. Key proposals include:

- Proposer-Builder Separation (PBS): This mechanism separates the proposers’ and builders’ roles in transactions, which in turn reduces the tendency towards centralization. With more distribution of responsibilities, the MEV landscape will be fairer with PBS.

- Encrypted Transaction Ordering: This would encrypt transaction details until finalization, making the visibility of transactions exploitable by malicious actors. Such innovations would be likely to curtail front-running and restore trust.

- Regulatory Alignment: Clear guidelines on MEV practices can help differentiate legitimate optimization from abusive behavior. Aligning MEV mechanisms with antitrust principles ensures competitive and equitable ecosystems.

- Community Oversight: Encouraging community-driven solutions, such as decentralized block-building protocols, can mitigate power concentration and uphold Ethereum’s decentralized ethos.

The Dual Nature of MEV

MEV is both a driver of innovation and a source of risk. On one hand, it incentivizes participation, enhances security, and ensures market efficiency. On the other, it can lead to centralization, exploitation, and ethical dilemmas.

As Ethereum and DeFi continue to expand, MEV remains a double-edged sword. The challenge lies in harnessing its potential while mitigating its downsides. Striking this balance will determine whether Ethereum can remain true to its vision of decentralization.

Conclusion: The Future of MEV

As innovation and regulation go hand in hand in the MEV area, it is about adaptation. Zero-knowledge proofs and more sophisticated cryptographic tools provide much promise for solving many of the problems with MEV. Meanwhile, alignment in MEV practices can be drawn out by developers, regulators, and the community in general to meet core blockchain values.

As MEV continues to evolve, it’s sure to shape at least the future of Ethereum and DeFi. As the blockchain ecosystem works through its various complexities transparently and innovatively, MEV can be a force for good, rather than a tool for exploitation.

FAQs

1. What is Maximal Extractable Value (MEV)?

MEV refers to the additional profit extracted by prioritizing, excluding, or reordering transactions within a block before its validation on a blockchain.

2. How does MEV impact Ethereum?

MEV improves Ethereum’s efficiency and incentivizes network participation but raises concerns about centralization, fairness, and potential exploitation.

3. What are some common MEV strategies?

Popular MEV strategies include arbitrage, liquidation, sandwich attacks, front-running, and back-running. These strategies often exploit transaction ordering.

4. How has MEV evolved with Ethereum’s transition to proof-of-stake (PoS)?

The transition shifted MEV extraction responsibility from miners to validators, introducing a new hierarchy involving searchers and builders.

5. What role do mempools play in MEV?

Mempools temporarily store unconfirmed transactions. Their flexibility allows builders to reorder transactions for profit, complicating fairness and regulatory oversight.

References

Share on Social Media: