Bitcoin surged to over $75,000 to break its previous all-time high in a move that will send ripples across the globe’s financial ecosystem. Investors and analysts alike have been keeping a watchful eye on this jump, as this rally in price coincides with rampant speculation ahead of the U.S. presidential election on November 5.

Bitcoin New ATH

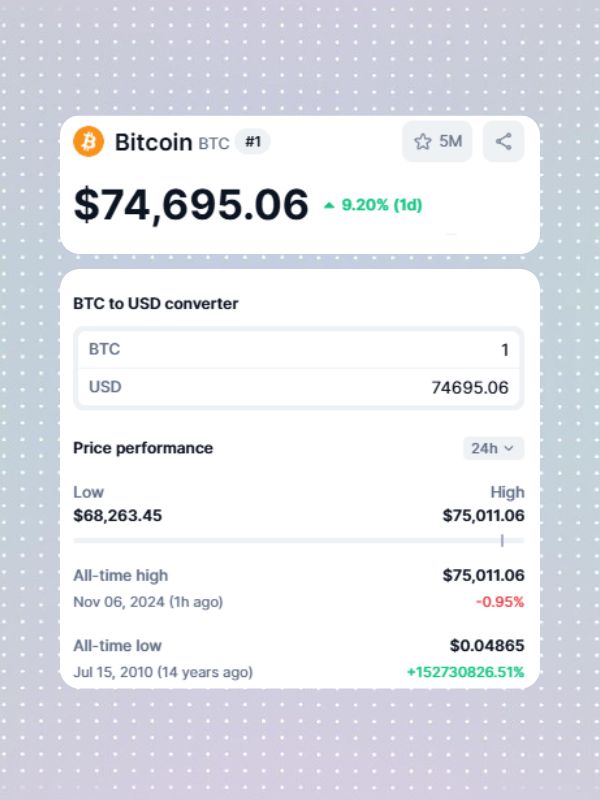

Data from CoinMarketCap had Bitcoin as high as $75,431 (at the time of writing). That jump has extended Bitcoin’s market capitalization to more than $1.4 trillion, indicating how much huge capital currently is flowing into the cryptocurrency market.

Election’s Influence on Bitcoin’s Momentum

This has resulted in increased volatility in crypto markets, CNBC quoted experts as saying. They added that a full-on victory by former Vice President Donald Trump might propel Bitcoin further up since he has lately become ‘pro-crypto’ with many believing his presidency spells good news for the crypto industry. On the contrary, a victory by Vice President Kamala Harris could lead to short-term volatility as her policies may turn out to be adverse to the crypto sector.

Ryan Rasmussen, the Director of Research at Bitwise Asset Management, told Yahoo Finance: “The election is having a massive influence on crypto. Expect bitcoin and crypto more broadly to be choppy in the days ahead until we have definitive election results.” The man believes that in case Trump wins, Bitcoin will set a new record high. Meanwhile, if Harris prevails, there could be a short-term sell-off that may take weeks or even months to recover.

All-time high reaches over $75,000 (Source: Coinmarketcap)

Bitcoin’s Post-Election Track Record

Historically, Bitcoin has performed well after the elections, posting gains after the U.S. elections in 2012, 2016, and 2020. During those years, it surged 87%, 44%, and 145%, respectively, during the three months after an election. Analysts explain that factors such as the halving cycles of Bitcoin and changes in policies at the US Federal Reserve during election years have often coincided with favorable macroeconomic conditions for cryptocurrency.

It’s also been posited that this election could catalyze similar gains, with many expecting further rate cuts and an uptick in inflationary concerns due to rising government deficits. Bitcoin has drawn investors seeking to protect wealth amidst uncertain fiscal and monetary policies, perceived as a hedge against inflation.

Expert Insights: Is a New High Imminent?

According to CryptoQuant analysts, Bitcoin is poised for a further uptick in the days ahead. James Davies, CEO of Crypto Valley Exchange, commented, “For now, everyone we’ve spoken to is keeping their powder dry. There’s likely to be massive short-term volatility whichever outcome.”

History would suggest that the price trajectory of Bitcoin post-major elections was at an all-time high. If the market conditions continue to stay on track, then the establishment of a new all-time high for Bitcoin could be pretty imminent, which would further cement its position as a digital asset of global importance.

Stay tuned to update breaking news in the cryptocurrency market.

Share on Social Media: