In a shocking turn of events, Bybit hacker, one of the world’s leading cryptocurrency exchanges, has fallen victim to a massive security breach, resulting in the loss of $1.4 billion in digital assets. The incident, confirmed on February 21, 2025, has been labeled the largest hack in the history of the crypto industry, surpassing previous high-profile breaches and serving as a stark reminder of the vulnerabilities within centralized platforms in the decentralized finance space.

The attack exploited Bybit’s infrastructure through a sophisticated method involving the manipulation of the exchange’s user interface (UI). Hackers spoofed the UI, deceiving the operational team into approving a malicious transaction that drained approximately 401,346 ETH from an Ethereum cold wallet. The stolen assets, valued at around $1.4 billion at the time of the breach, were swiftly transferred to an unidentified address, leaving the crypto community reeling. Blockchain analysis suggests the funds have since been split across multiple wallets, complicating recovery efforts.

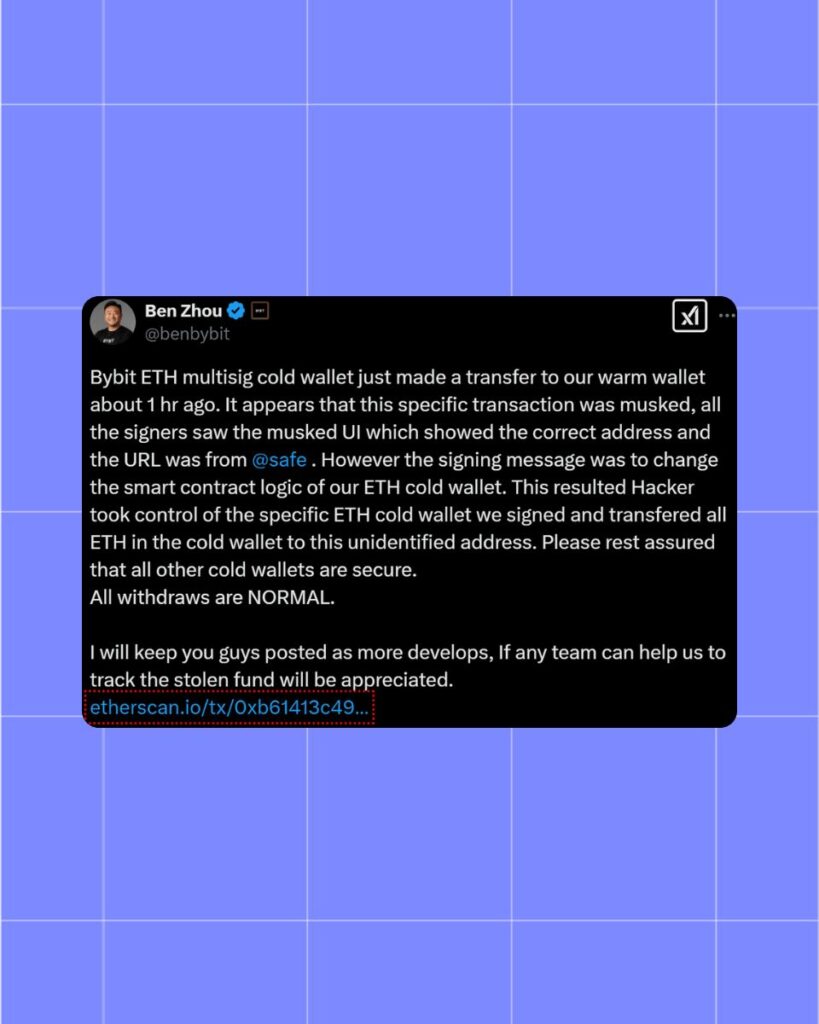

Bybit’s CEO and co-founder, Ben Zhou, responded promptly to the crisis. On February 21, Zhou took to X to confirm that the hacker had “taken control of the specific ETH cold wallet” and assured users that all other wallets remained secure, with withdrawals proceeding normally. Later that day, he announced a livestream to address the incident, provide updates, and answer community questions, signaling a commitment to transparency. During the livestream, Zhou revealed that the attackers employed a “masked” transaction technique, altering the smart contract logic of the wallet while presenting a legitimate-looking UI to the signers. “We saw the correct address, but the signing message changed the contract,” Zhou explained, suggesting a possible compromise of the signers’ systems.

The fallout was immediate. Posts on X reported a rush of withdrawals as users feared potential insolvency, with Zhou acknowledging “massive withdrawals in the last two hours” during the livestream. Despite this, he maintained that Bybit remains solvent, with client assets backed 1:1, and that the exchange’s treasury could cover the loss if the funds are not recovered. “No matter what, your money is safe,” Zhou reassured users, a sentiment echoed in a follow-up statement from Bybit’s official X account. The company also confirmed it is processing withdrawals, though some delays have occurred due to network congestion, with 70% of transactions reportedly completed successfully.

Market reactions were swift, with Bitcoin dipping to $96,632 and Ether falling to $2,685, a 1-2% drop. reflecting shaken confidence. However, Zhou emphasized that the breach was an isolated incident, not indicative of broader crypto ecosystem flaws. To mitigate damage, Bybit is not planning an immediate purchase of $1.4 billion in Ethereum, as initially speculated, citing the massive volume involved. Instead, Zhou disclosed that the exchange is securing a bridge loan to maintain operations while the investigation continues.

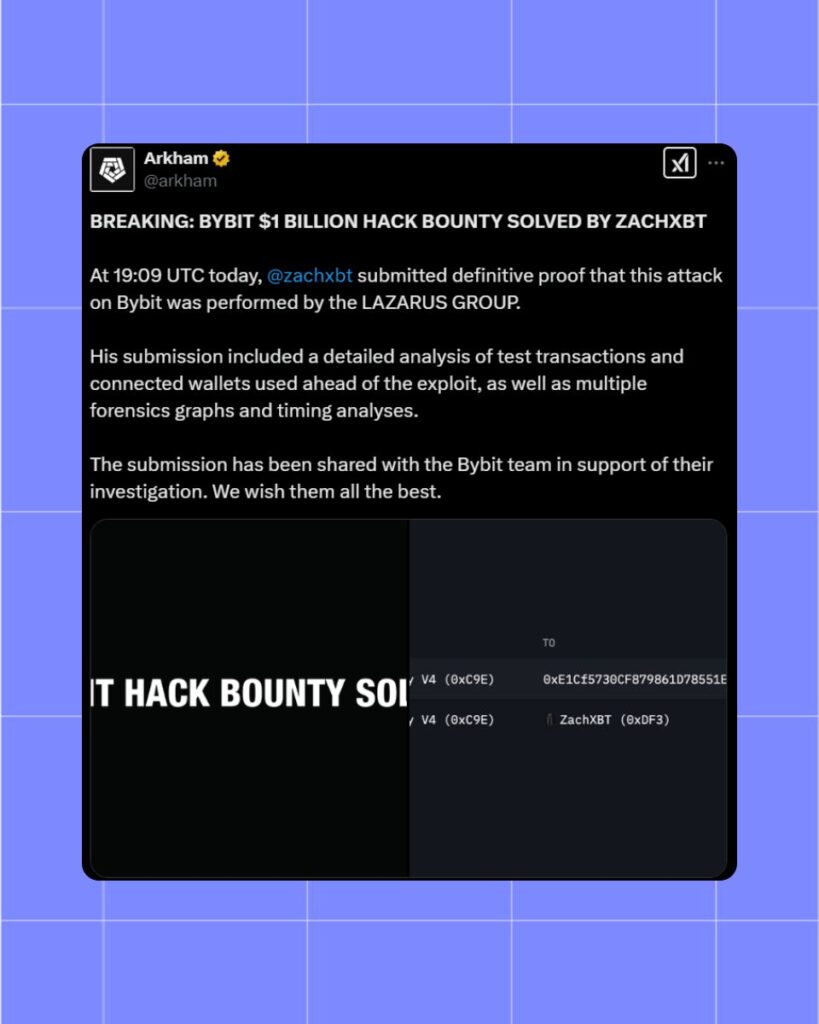

Bybit has escalated its response by reporting the hack to relevant authorities and collaborating with on-chain analytics providers to trace the stolen funds. On February 22, the exchange updated users via X, stating it had worked “quickly and extensively” to identify and demix implicated addresses, with further updates promised as developments unfold. Blockchain sleuth ZachXBT has linked the attack to suspicious outflows and suggested the possible involvement of sophisticated actors, though no definitive culprit has been named.

Historically, crypto exchanges have been prime targets due to their centralized nature. The Bybit hack dwarfs previous incidents like the $622 million Ronin Network breach in 2022 and the $600 million Poly Network attack in 2021. Unlike those cases, where some funds were recovered, the outlook for Bybit’s $1.4 billion remains uncertain. Arkham Intelligence has launched a bounty hunt to identify the hacker, but the complexity of tracing secret accounts poses a significant hurdle.

The incident has reignited debates about exchange security. Experts note that while blockchain is secure, centralized platforms like Bybit are vulnerable to human error and single points of failure. Zhou’s admission of a UI spoofing exploit has fueled calls for enhanced protocols, such as multi-signature wallets with stricter verification and real-time intrusion detection.

For Bybit, the stakes are high. Beyond the financial loss, the exchange faces a reputational crisis that could erode its user base of over 26 million. Zhou’s assurances and proactive communication aim to rebuild trust, but the company must bolster its defenses and transparency to recover. The broader crypto industry, too, is watching closely, as this record-breaking hack could shape future security standards and investor confidence. As of now, Bybit continues to operate, with Zhou and his team in an all-hands-on-deck effort to manage the fallout and ensure customer service remains robust amidst this unprecedented challenge.

MevX will continue to update the latest news! Stay tuned!

Share on Social Media: